When we established Binaryoptions.com, we aimed to simplify binary options trading. We also wanted traders to find secure and reliable brokers, so we developed the trust score.

As experienced traders, we understood that not every player in the finance industry could be trusted. After all, not all brokerage firms strive to provide best-in-class services to their clients or have their best interests at heart.

So, we embarked on a mission to answer a crucial question for traders: Can a trader trust his broker with his funds?

What led us to develop the trust score?

We want traders to trade securely. Our zeal for knowing whether a trader can trust a broker led us to develop a valuable tool called the trust Score. The trust score is not just an algorithm—it is way more, considering our in-depth reviews. We use this algorithm to give traders a quick and comprehensive rating of a broker’s trustworthiness. It is part of our review methodology and brokers’ ratings.

Our trust score helps traders know whether it is worth trading with a broker.

We present the trust score based on extensive research and data collection. Our in-house industry specialists with years of trading expertise contribute to developing a rating for each broker.

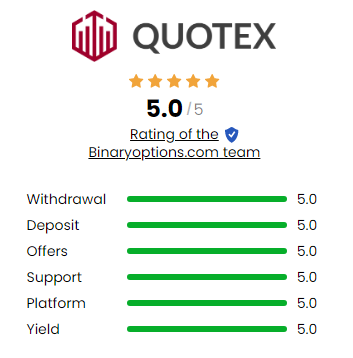

We assign a numerical rating ranging from 1 to 5 to each broker.

Traders can look at these scores before trading with any broker. Brokers with higher scores indicate greater trustworthiness.

How do we calculate the trust score?

Calculating a broker’s trust score involves considering several factors. Generally, our expert team considers the following things when deciding the trustworthiness of a trading platform.

- The total number of years the broker has operated.

- The corporate structure of the trading platform (e.g., publicly traded or a bank),

- The number and quality of regulatory licenses held and

- The expert opinion score provided by our team.

We recognize and incorporate regulatory licenses from various jurisdictions and countries into our trust score algorithm. UBroker licenses are usually categorized into three tiers.

Tier 1 trading platforms operate in the most severe regulatory framework. On the contrary, brokers with Tier 3 licenses represent the least.

Here is some information about the jurisdictions to which most trading platforms belong. Of course, traders must check the broker’s regulatory status before signing up.

Tier 1 Jurisdictions (Indicates High Trust):

- Hong Kong – Securities Futures Commission (SFC)

- Australia – Australian Securities & Investment Commission (ASIC)

- Ireland – Central Bank of Ireland (CBI)

- Japan – Japanese Financial Services Authority (JFSA)

- Switzerland – Swiss Financial Market Supervisory Authority (FINMA)

- New Zealand – Financial Markets Authority (FMA)

- USA – Commodity Futures Trading Commission (CFTC)

- Investment Industry Regulatory Organization of Canada (IIROC)

- United Kingdom (UK) – Financial Conduct Authority (FCA)

- Monetary Authority of Singapore (MAS)

Tier 2 Jurisdictions (Indicates Average Trust):

- India – Securities and Exchange Board of India

- South Africa – Financial Sector Conduct Authority (FSCA)

- Russia – Central Bank of Russia (CBR)

- Cyprus – Cyprus Securities & Exchange Commission (CySEC)

- China – China Banking Regulatory Commission (CBRC)

- Thailand – Securities and Exchange Commission

- Israel – Israel Securities Authority (ISA)

- United Arab Emirates – Dubai Financial Services Authority (DFSA)

Tier 3 Jurisdictions (Indicates Low Trust):

- Vanuatu – Vanuatu Financial Services Commission (VFSC)

- Bermuda – Bermuda Monetary Authority (BMA)

- British Virgin Islands – BVI Financial Services Commission (FSC)

- Belize – Financial Services Commission (FSC)

- Bahamas – Securities Commission of the Bahamas (SCB)

- Cayman Islands – Cayman Islands Monetary Authority (CIMA)

- Mauritius – Mauritius’ Financial Services Commission (FSC)

Trust score ratings explained:

We analyze brokers based on different parameters. These parameters help us generate trust score ratings for different brokers. Based on the ratings, brokers fall into different categories:

Highly Trusted (Trust score = 5/5)

Brokers with a “Highly Trusted” rating are the most trustworthy in the trading industry. We have complete confidence in these firms. Some of our expert traders have personally opened and funded accounts with them numerous times.

However, it’s essential to note that even highly trusted brokers may encounter unforeseen challenges. Certain market anomalies can significantly impact brokers’ operations.

Trusted (Trust score = 4/5)

Our “Trusted” rating indicates that brokers are reliable and trustworthy. However, these brokers are just one tier below the highly trusted rating.

Although the rating is low, often due to differences in regulatory licenses or corporate structures, these brokers remain a solid choice for traders.

Average Risk (Trust score = 3/5)

Brokers in the “Average Risk” category are generally safe. However, However, traders should inspect them more closely before opening a live trading account.

Therefore, traders should ensure these brokers have regulatory authorization in their country of residence. This will provide additional protection.

High Risk (Trust score = 2/5)

Traders should scrutinize high-risk brokers before opening an account. These brokers often operate without credible regulatory licenses and may have a record of legal or financial problems.

So, traders should think twice before they sign up with these brokers.

Do Not Trust (Trust score = 1/5)

Traders should avoid brokers receiving a “Do Not Trust” rating. At BinaryOptions.com, we never recommend opening an account with brokers who do not provide adequate protections for traders and their funds.

These trust scores can be highly effective in helping you choose the best brokers in the industry.

For more information, please message us via our contact page or read more about us!

Get more information about us:

Frequently Asked Questions (FAQ):

How can I determine if a broker is trustworthy?

Assessing a broker’s trustworthiness involves considering several factors. First, traders should look for brokers with a long track record in the industry. A broker’s years in business can indicate reliability. Traders should also check if reputable authorities regulate them. Regulatory oversight adds a layer of protection for traders. Finally, reviewing the trust score presented by our experts can also help gauge their trustworthiness.

Are brokers with higher trust scores always the best choice?

Brokers with higher trust scores generally indicate greater trustworthiness. However, it’s essential to consider your specific needs and preferences. Traders should evaluate available trading instruments, platform features, customer support, and fees. A broker with a slightly lower trust score but better suited to your trading requirements may still be a reliable option.

What should I do if a broker I’m interested in has a lower trust score?

Suppose you come across a broker with a lower trust score. First, you should investigate the reasons behind the lower rating. For instance, you must check for specific regulatory licenses or historical legal or financial issues.

Can I trust brokers without any regulatory licenses?

Brokers operating without credible regulatory licenses pose a higher risk for traders. Compliance with regulations ensures that brokers follow specific criteria and protect customer money. As a result, traders should select brokers with certifications from credible regulatory organizations. However, suppose a broker without a license is the only option available. In that case, traders should exercise extreme caution and thoroughly research the broker’s reputation, history, and client feedback before considering any investment.