Yes, binary options trading is legal in Kenya.

Trading binary options in Kenya is legal but not fully regulated. The Kenyan government and authorities have not established comprehensive rules protecting investors when trading binary options.

The main regulatory body for the financial industry in Kenya is the CMA (Capital Markets Authority). Since its establishment in 1989, the CMA has been operating as an independent body in Kenya to monitor, license, and supervise all the financial market intermediaries across Kenya.

Traders in Kenya will face a higher level of risk as there are no clear regulatory standards. They will have to conduct their research and choose an offshore broker that is legal, authorized to provide services, and suits their needs.

Let’s find out how to trade binary options in Kenya in the step-by-step guide below.

Key facts about binary trading in Kenya

- Binary Trading is legal in Kenya but is not fully regulated.

- Traders can start to trade Binary Options with a low minimum deposit of $10

- Different brokers with a high return, like Pocket Option or Quotex are available.

- Binary brokers in Kenya support local payment methods.

A Step-by-Step Guide to Trading Binary Options in Kenya

Venturing into binary options trading in Kenya as a new trader? Acquiring a thorough understanding of the trading process is vital. With the right knowledge and a strategy suited to the Kenyan market, binary options can yield significant returns. Our step-by-step guide is your pathway to successful trading in Kenya.

1. Pick an available binary options broker in Kenya

Traders must first verify the broker’s regulatory status. Binary brokers are usually regulated by well-known regulatory organisations, including ASIC, CySEC, and the Financial Services Authority (FSA), which guarantee the safety of traders’ funds.

It is essential to remember that binary options are not regulated in many countries. Apart from checking that a broker is regulated, traders should also review the minimum deposit and trade sizes required to ensure they align with their trading strategy and budget.

Engaging with a licensed broker with minimum deposit and trade sizes that align with your strategy is crucial to ensure your safety and profitability as a trader. A licensed broker will offer you a fair price unaffected by market manipulation, ensuring your capital is not in danger. Binary options traders based in Kenya can use any of the following brokers:

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

from $ 5

(Risk warning: Trading is risky)

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

from $10

(Risk warning: Trading is risky)

Quotex

Quotex is a legal trading platform in Kenya. A well-known brokerage prioritising customer experience, Quotex is a prominent service for trading options and derivatives.

Quotex is known for building infrastructure and being the first company in the industry to provide binary options and contracts for differences that Bitcoin and other cryptocurrencies back.

A wide range of trading choices, including FX, equities, indices, and commodities like silver and oil, are available on Quotex. Additionally, traders can transact in four well-known cryptocurrencies: Bitcoin, Ethereum, Litecoin, and Ripple.

Get a free deposit bonus of 50% at Quotex with our promotion code “bobroker50“

You can only use this bonus code by signing up via our website.

Features

- Minimum Deposit: $10

- Account Types: Demo, Live

- Trading Platform: Web platform & Mobile platform

- Instruments: Currency pairs, commodities, indices, and cryptocurrencies

- Minimum Trade: $1

- Expiry Times: 1 minute to 4 hours

(Risk warning: You capital can be at risk)

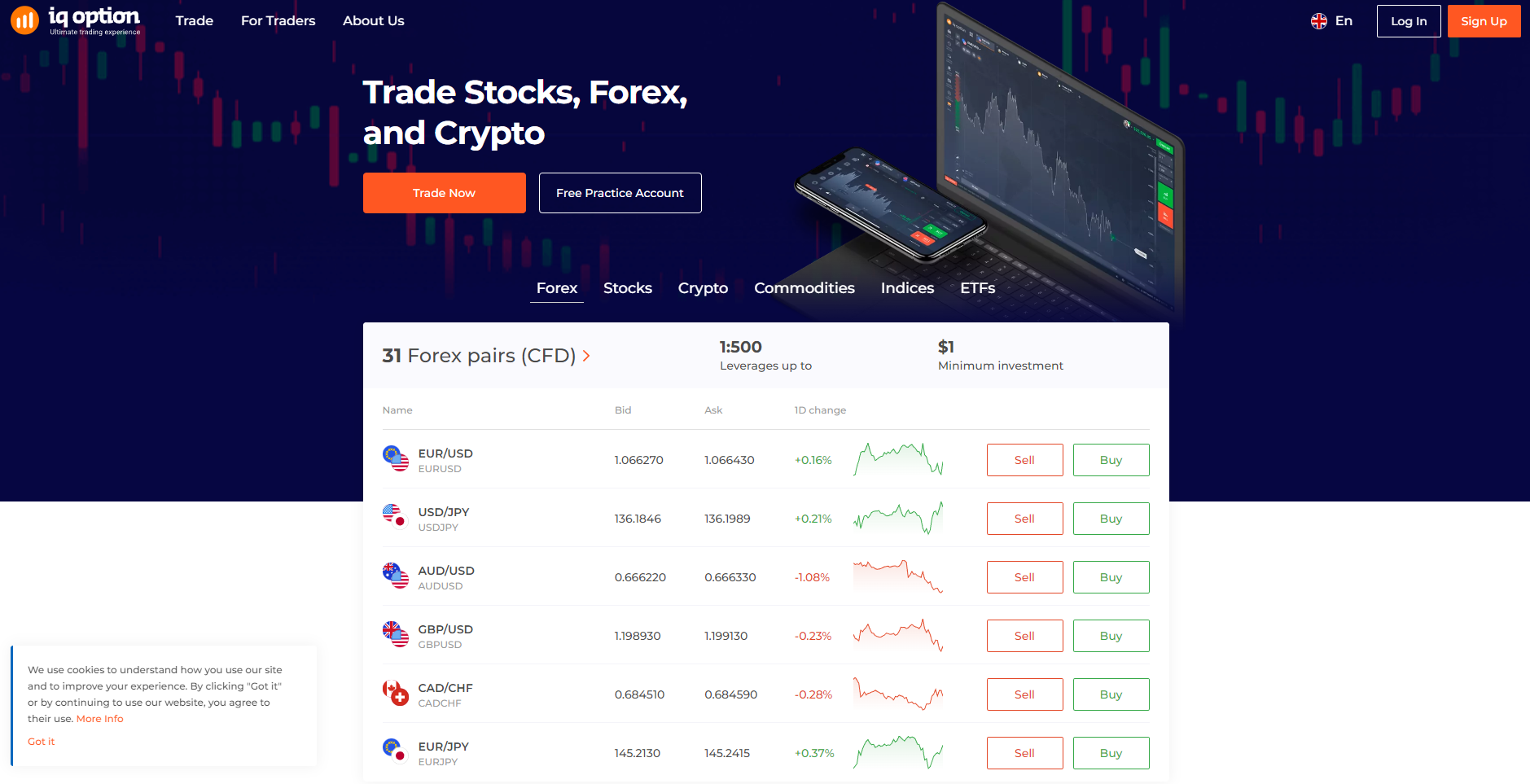

IQ Option

IQ Option was Founded in 2013. It is a trusted binary options broker for Kenyans. IQ Options is best known for its dependable trading platform. It offers a smooth binary options trading interface and CFD with competitive fees.

IQ Option is a legal trading platform in Kenya. A brokerage that provides its services to many countries, IQ Option, allows traders to have instant access to investing anywhere, anytime. They are award-winning software recognised by industry experts, allowing traders to customise the platform to fit their needs better. With over 300 + assets available, including those for forex, cryptocurrencies, and commodities, traders can trade in established industries to new companies.

With an intuitive interface and a team of professionals offering 24/7 support, IQ Option is a popular first choice for beginners and experienced traders. They also provide traders with guides and resources for more research and knowledge.

(Risk warning: You capital can be at risk)

Pocket Option

Pocket Option is a legal trading platform in Kenya—one of the earliest platforms with a dedicated app for tracking trades. Pocket Option holds a valid brokerage license from the Autonomous Island Of Mwali. With multiple features such as VIP customer features, regular interface updates and new platform themes, traders can customize the platform and trade in their style.

Pocket Option facilitates trading for customers worldwide and is available on various social media platforms, including Facebook and YouTube.

Features

- Regulation: By MISA

- Minimum Deposit: $5

- Minimum Per Trade: $1

- Demo Account: Available

- Mobile Trading: Supported

- Instruments: Stocks, Crypto and Binary Options

(Risk warning: You capital can be at risk)

2. Sign up for a trading account

Regardless of the company or kind of account you select, you’ll need to have a few things ready before you begin the account opening process. Your basic personal information will be required to register your account. This information includes your date of birth, social security number, and nature of employment.

You’ll be asked about your attitude toward accepting financial risks and how long you anticipate holding the investments.

You don’t need to worry about whether your answers are precise to the percent or penny. This information is not required for verification and is used by the broker to create a better risk profile to reach your goals. If circumstances change and you wish to access riskier asset classes, you can always return to the site’s profile section and adjust your answers.

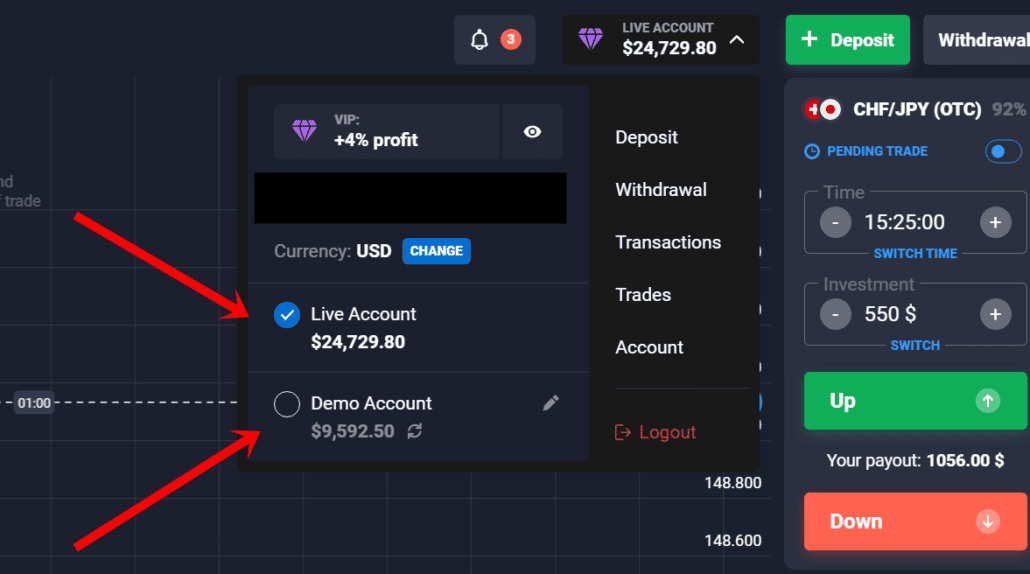

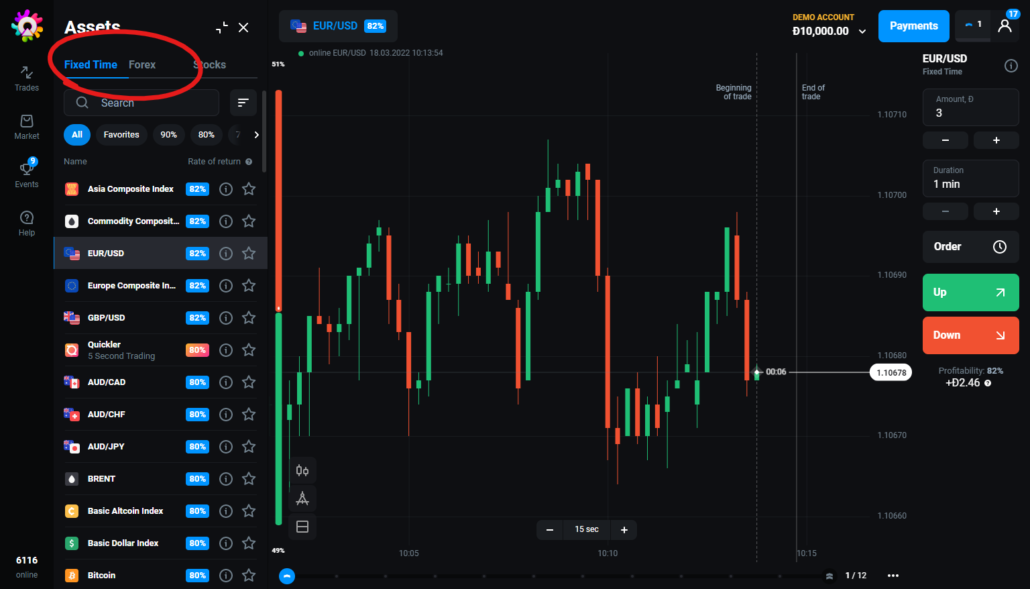

3. Use a demo or live account

Trading may be emotionally taxing, particularly for beginners trying their hand at binary options trading for the first time and might be investing their money in something they don’t understand.

Since emotions may affect judgment, a demo account would help traders develop emotional control by allowing them to experience profits and losses without risking money. This can assist in better preparing students for future real-money trading.

4. Pick an asset to trade

Trading a small number of assets streamlines trading procedures. It allows traders to concentrate more time and energy on analysing a small number of assets rather than a large number.

The market frequently offers a variety of assets for selection. When novice traders trade fewer assets, they can better understand the efficacy of their trading techniques and use their cash more wisely. For a better assessment of their trades, choosing assets with more volatility allows for more opportunities to execute trades since price fluctuations are bigger and more obvious.

5. Make an analysis

By identifying trade patterns, trends, and possible signals that advise traders when to enter and leave a trade, market analysis helps traders in identifying trading opportunities. As a result, they can enter positions that match their trading approach. Traders can evaluate the degree of risk associated with each transaction by studying the market before making a trade. Traders typically use technical indicators that are accessible on the broker’s platform.

Technical indicators consist of 3 categories:

- Trend – These indicators indicate price movements. They are also referred to as oscillators sometimes.

- Momentum – Momentum signals are utilized to determine how strong a pattern is. They can also be used to indicate reversal moments in your trades.

- Volatility – Volatility indicators measure the degree to which market changes cause price swings.

6. Place the trade

Binary options are among the most straightforward options contracts to trade since traders base their decisions on whether they think the value of an asset will rise or fall. Because there are just two possibilities with binary options, traders who are new to the financial markets find them appealing. Traders must decide which option to invest to complete a binary options deal.

Despite binary options’ seemingly straightforward nature, traders should first understand how they operate, the markets and timeframes in which they may trade, the benefits and drawbacks of these commodities, and the firms authorised by law to provide binary options.

7. Wait for the result

Traders would either lose their original investment or earn a payment depending on whether or not their trade was successful or unsuccessful. Traders must persist in their regular monitoring of the market to track their progress and make adjustments to their trading strategy to mitigate risk.

Payment Methods Tor traders in Kenya

The majority of Kenyans use online digital transaction methods and e-wallets daily. Online bank wire transfers and credit card transactions are accepted widely across Kenya. Hence, Kenyans will find it easy to fund their trading accounts with any online brokers such as Pocket Option or IQ Option.

Note that the number of payment methods available to deposit for different trading accounts can vary based on the platform’s rules and regulations. So, check the available deposit method first before opening a trading account!

Some popular payment methods are:

- MPESA – a popular mobile phone-based money transfer service. Traders in Kenya can use it to find their trading accounts.

- E-Wallets – In Kenya, payment processors like PayPal are also accepted. This is often a secure approach since such accounts are connected to bank accounts, which makes it simpler to confirm the trader and the broker. To improve the system’s efficiency and transparency, the Mexican government is encouraging the adoption of electronic payment methods rather than cash or checks.

- Credit Cards – Many banks in Kenya provide international credit cards like Visa, MasterCard, and American Express, most of which are accepted by the brokers mentioned above.

How Do You Make Deposits and Withdrawals in Kenya?

How do I deposit?

You may fund your account in several ways. Various deposit options are available depending on the broker. After logging into your account, select the deposit page. You may pick the most convenient way to add money to your account here.

To deposit funds, traders can follow these steps:

- To deposit, visit the broker’s website or open the application.

- Login to your trading account.

- Click on the ‘deposit funds’ or ‘add funds’ option the broker offers.

- Enter the deposit amount.

- Choose a payment method.

- Authenticate the payment.

After traders validate their payment, the broker authenticates it and funds your trading account with the entered amount. You can use this amount to trade binary options and earn profits.

How do I withdraw?

Most platforms dictate how you withdraw based on how you made the deposit. If your account was funded with an e-wallet, you may only be allowed to withdraw money back into the same e-wallet wallet. On the withdrawal page, you may make a withdrawal application. Depending on the broker, the withdrawal process may range from a few hours to weeks. Additionally, depending on where you are, conditions may change.

To withdraw funds, traders can follow these steps:

- Choose the ‘withdraw funds’ or ‘withdraw my funds’ option on the dashboard.

- Enter the amount you wish to take out.

- Choose a withdrawal method.

- Submit the request

After traders validate their payment, the broker authenticates it and funds your trading account with the entered amount. You can use this amount to trade binary options and earn profits.

Benefits of Binary Options Trading in Kenya

After learning so much about Binary Options Trading, you must wonder about its benefits.

So, let’s look at them:

1. High Rewards

Trading binary options can bring you high returns on your investments. Compared to other financial trading instruments like FOREX or fixed-time trading, trading binary options can return up to 90% of your initial investments, while FOREX provides a much lesser return of roughly 10%.

Binary options trading provides traders with a way to increase their capital quickly. This relatively new concept in Kenya is gaining momentum rapidly because of its high-reward nature.

2. Fixed Risk

Although the risk is high in Binary options trading, it can never exceed your deposit amount.

Unlike Forex trading, where losses can be uncertain, the potential returns and losses are clearly defined in Binary options trading.

As a trader, you always know how much capital you can lose.

Depending on your risk attitude, you can choose how much you want to invest for every trade, which is an excellent benefit of binary options trading.

Moreover, some brokers reward their traders even if their predictions are wrong. They provide 5-15% cashback on your lost amount, which means traders do not lose as much of their capital even if their trades do not work out.

3. Zero Complications

Binary options trading is simple. There can only be two outcomes, traders predict whether the asset would rise or fall in price.

Beginners often try their hands at binary options trading at the demo accounts provided by brokers, which allows them to get a feel of the market without losing any actual capital.

The platform interfaces of such brokers are usually user-friendly and easy to customise, which means new users can quickly learn the platforms and spend more time analysing the market or placing trades.

4. Quick Process

Unlike other financial instruments, binary options are fast. Traders do not have to wait days or months for the result of their trade. Trades can be placed instantly, and the results can be obtained in less than a minute.

The quick process allows the users to trade multiple times daily and enhance their profits. It is best for people looking to make quick profits and get multiple returns on their capital.

5. Plethora of Assets

You can trade with almost every asset in Binary Options Trading. Most assets are available for traders to trade binary options with.

You can assess the market and choose the asset that is bound to increase in the next hour.

Traders often find themselves working well with only a few assets; this trade allows them to invest in those assets only and increase the probability of their winnings.

6. You can close your trade before the stipulated time

Unlike Forex trading, where you cannot back off once invested, Binary Option allows you to step back between the trade time.

For example: if your trade time was 15 minutes and, entering the 12th minute, you feel the price will now come down, you can close a trade right away and keep the profit.

The closure is free, and the asset’s value will be considered the final value upon closure.

So, with Binary options trading, you can choose the trading time.

7. You can trade multiple times a day

There’s no limit on the amount of trades a trader can carry out as long as its during live trading hours.

As a trader, you can trade for the entire day and quickly double your investments. Some traders also treat binary options trading as their full-time career.

However, extensive knowledge of securities and a lot of time and research are required for traders to turn binary options trading into a full-time career. Inexperienced traders will often see binary options trading as a quick way to get money without fully understanding the risks of trading.

Conclusion: You can trade safely with the right brokers in Kenya

Binary options trading is available in Kenya. With their economy reviving from the aftermath of the COVID-19 pandemic, Kenyan citizens are motivated to try out different things that can help them make a few extra bucks.

Financial markets can be tricky due to the risk factor, but the potential rewards are equally encouraging. Investing in instruments like Binary Options Trading with world-class brokers like Pocket Option, IQ Option, Olymp Trade, Binomo, and Expert Option can significantly boost Kenya’s financial sector and help traders reach their financial goals.

With extensive rewards, cashback, demos, and support assistance, these brokers motivate Kenyan citizens to explore the financial markets.

Frequently Asked Questions (FAQ)

What are the risks of binary trading options in Kenya?

Trading binary options comes with the inherent risk of losing 100% of the investment placed for the trade when the price doesn’t move in the direction you expect.

Can you trade binary options for free in Kenya?

Signing up for a demo account with a reliable binary options broker is a great way to trade these options for free in Kenya. But you must bear in mind that since demo accounts are loaded with dummy virtual money, the profits you make with it will also be virtual and cannot be transferred into a bank account.

How much money do you need in Kenya to trade binary options?

Most binary options brokers demand a minimum deposit of 10 USD. So, Kenyan traders need about 1450 Kenyan Shillings to trade binary options.