Yes, binary options trading is legal in the United States but is highly regulated and restricted to specific trades and platforms.

As such, US traders are only allowed to trade with brokers and exchanges regulated or licensed by the Commodity Futures Trading Commission (CFTC). CFTC rules protect traders from fraud in the binary options market and other markets, such as swaps and futures. This also means that the number of brokers legally operating in the US market is quite limited compared to other countries. These platforms must comply with rigorous financial standards and conduct.

With these strict regulations implemented, traders can rest assured that their money is safe and that the regulated brokers have their best interests in mind. Read on to find out more about trading binary options in the USA.

Key facts on binary options trading in the US

- NADEX as a Top Broker: NADEX (North American Derivatives Exchange) is widely recognised as the best broker for binary options in the U.S. It is fully regulated by the CFTC, ensuring high transparency and security for traders. NADEX offers a wide range of binary options products and tools suitable for beginners and experienced traders.

- Regulation: Binary options trading in the U.S. is highly regulated and only permitted on regulated exchanges to ensure investor protection. These exchanges must comply with regulations enforced by the Commodity Futures Trading Commission (CFTC).

- Limited Broker Options: Due to strict regulatory requirements, the number of brokers that legally offer binary options trading in the U.S. is quite limited compared to other countries. This means fewer choices for traders but increased safety through rigorous oversight.

If you are unsure of your binary options platform, ask yourself:

Where are they, and are they in the US? If so, make sure you are registered with the CFTC and National Futures Association.

- Is the platform regulated?

- What are the security measures in place?

- What is the reputation of the platform?

- How transparent are the platform’s fees and commissions?

- What are the terms of deposits and withdrawals?

- Is there a demo account available?

To avoid fraud, you should work with exchanges regulated by the US CFTC.

Regulation of the Binary Options Market in the US

The binary options market is regulated in the US by the Commodities and Futures Trading Commission (CFTC), and the North American Derivatives Exchange (NADEX) is an example of a broker in the US territory that is deemed compliant with US tax laws on investments.

What regulatory practices are binary options brokerages supposed to follow regarding the regulation of the binary options market in the US?

- As a baseline, binary options firms are expected to be well-capitalised. This means that any binary options brokerage firm that wants to start a business in the United States is expected to have a minimum capital requirement before their application is even considered.

- Some brokerage firms caused their clients to lose trading capital when they went insolvent. To prevent this, brokerage firms must keep their clients’ trading capital in sequestered accounts. No money can be drawn from these sequestered accounts to fund the brokerage firm’s operating costs. Not only does this force brokers to maintain good accounting practices, but it also protects traders in the event of brokerage firm insolvency.

- Regulators perform regular accounting checks to detect early trouble with the broker’s finances.

- Brokers are mandated to respond in writing to any accusations of wrongdoing by clients and to submit themselves to thorough investigations of any allegations without blocking the process or tampering with evidence.

These systems are in place in the US, and the CFTC has a reputation for taking its regulatory function seriously. In 2010, a broker was slammed with a $ 14 million fine after complaints of price manipulation by traders were investigated and found to be true. Such actions have set the US aside as a country that has taken a strong stance on effecting regulatory function on brokers.

Many of these regulatory frameworks are missing in several jurisdictions.

For instance, in some areas, anyone can set up a binary options brokerage for as low as $20,000. Such a development portends trouble for traders as there is virtually no regulatory oversight, and traders have no protection from financial and pricing malpractices.

A Step-by-Step Guide For Trading Binary Options in the USA

This is a go-to guide for navigating the world of binary options trading in the USA. The rules for binary options trading and the steps to take can get pretty detailed and not as transparent, so we’ve broken everything down to make it easier to understand whether you’re just starting or have some trades under your belt.

1. Choose a Regulated Binary Options Broker in the USA

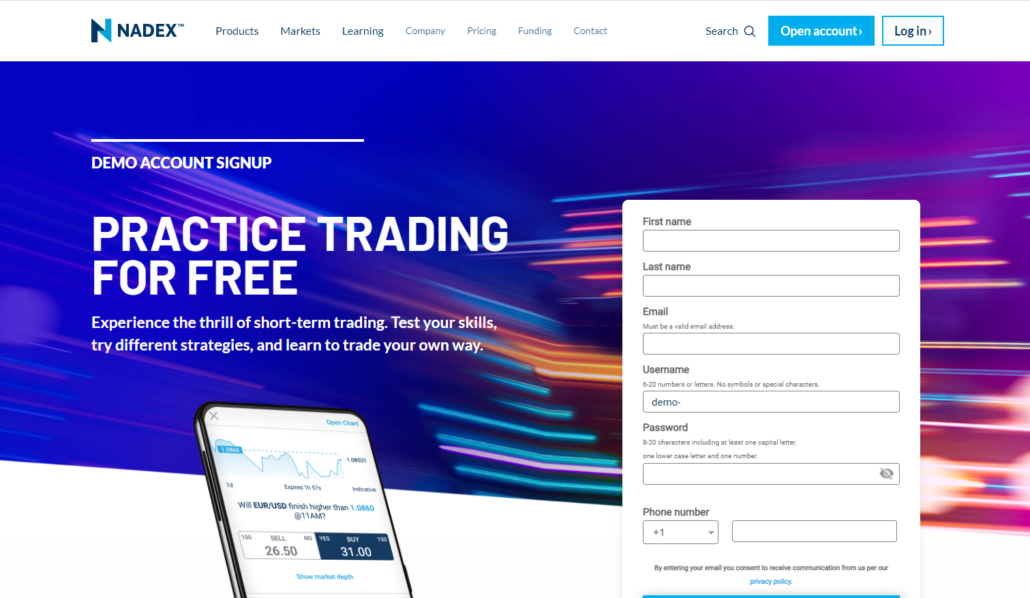

Ready to trade from the comfort of your home? First, you’ll need to pick a broker. We recommend NADEX (North American Derivatives Exchange), which is based in the US and regulated by the Commodity Futures Trading Commission (CFTC).

This makes it one of the few platforms where binary options trading is legal and regulated in the US. In contrast, US regulatory bodies do not regulate other brokers, which can pose risks and limitations for US traders.

The exchange was founded in 2004 and was initially named “HedgeStreet.” The founders aimed to build a marketplace to enable trading derivatives. However, by 2007, HedgeStreet had closed its doors.

In 2009, HedgeStreet was purchased by IG Group Holdings Plc. and rebranded as the North American Derivatives Exchange (NADEX). Nadex’s headquarters are in Chicago, Illinois.

The exchange enables trading binary options on various markets, including commodity futures, equity index futures, commodities, and foreign exchange.

Nadex offers two types of accounts – one for US traders and the other for traders from overseas.

Regulation

As mentioned above, the exchange is regulated by the US Commodity Futures Trading Commission. You can verify the details about its regulation on the CFTC’s website.

The regulatory authorities ensure that Nadex maintains the highest security and privacy standards. In addition to being available to US customers, the platform allows traders from over 40 countries to trade binary options.

Minimum Deposit and Fees

When you sign up, you must make a minimum initial deposit of $250. However, the industry average fluctuates around $500, making Nadex an attractive exchange for new traders.

After making your first deposit, you will instantly access the several markets available on Nadex.

Another advantage of using Nadex is that you do not have to pay additional brokerage commissions since it is an exchange. This brings down the processing fee when you place trades.

Traders must pay a fixed fee of $1 per contract. However, the exchange will waive the settlement fee if the trade expires in a loss.

Features like demo accounts, real-time charts with direct market access, news reporting, and the excellent leverage offered make Nadex the go-to exchange for trading binary options in the USA.

The weekly webinars, ebooks, and trading courses Nadex offers in the Learning Center can benefit new traders.

2. Sign up for a trading account

When you decide to trade with a broker, the first step is to set up an account. Some brokers might ask for a minimum deposit right away, while others offer the option to start with a demo account. Demo accounts are often loaded with $10,000 in virtual funds to allow traders to practise trading and get comfortable with the platform without risk.

The platform would ask for your personal information, including pictures of your identity card or passport, to verify your identity. By requiring this, the broker must comply with strict anti-laundering regulations.

Once traders feel ready, they can move on from the demo account to a real trading account.

3. Use a demo or live account

Here’s a tip we want to share with new traders: Hold off on trading with real money first. If you’re still getting to know a broker and figuring out if they’re a good fit, take advantage of their binary options demo account.

A demo account functions similarly to a live trading account, though the features may vary slightly depending on the broker’s specific terms and conditions. The main difference is that you’ll be trading with virtual money in a demo account, not actual cash. This setup lets you practice and learn the ropes without the risk of losing actual money.

4. Pick an asset to trade

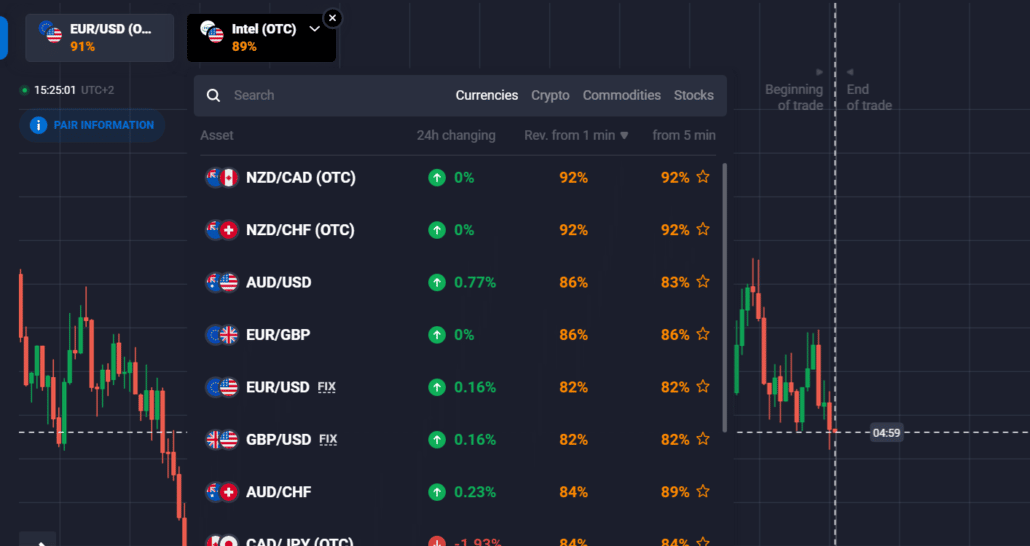

Currencies: Trading currencies is the most common type of binary options trading. As a trader, you’ll speculate on the exchange rates of currency pairs like EUR/USD, GBP/USD, JPY/USD, and more, depending on the options available on your trading platform.

Commodities: Commodities are often a great starting point for newcomers to binary options trading. They are considered a safer, low-risk investment. Commodities like silver, gold, oil, and cocoa are popular choices that can help you build your trading experience and confidence.

Stocks: While traditional stock trading has existed for a long time, binary options trading with stocks is a more recent development. It offers an exciting and potentially rewarding way to trade. However, it’s essential to understand stock trading basics first, as experienced investors particularly favour this asset class.

Indices: Binary options platforms also allow traders to speculate on indices such as the DAX-30, FTSE-100, DOW Jones, and S&P 500. The specific index available to you will depend on the broker you choose. Top brokers offer indices from multiple countries, including the USA, UK, Germany, Japan, and France.

Each asset class has unique characteristics and requires different strategies, so it’s wise to familiarise yourself with each type before entering trading.

5. Make an analysis

Setting up your trade is straightforward. First, pick a timeframe that aligns with your trading style. If you prefer quick trades, you might opt for short-term options like 30, 60, or 120 seconds. If you want to give your trades more room to develop, consider longer durations, like 3 or 5 minutes or even longer.

Once you’ve picked a timeframe and everything looks set, just hit a button to lock in your trade.

It’s time to select the right charts and indicators to guide your trading decisions. For a deeper insight into various indicators and strategies, check out more detailed info here [insert link]. This will help you make smarter, more informed trading choices.

6. Place the trade

Once your trading strategies are lined up, the next big move is to place your trade. This step is all about staying sharp and observant. Look at past trends and think about what’s happening right now. This bit of homework will boost your confidence and help you feel ready to make your move.

7. Wait for the result

Once you’ve finished a trade within the set time or expiry period, and if your prediction was correct, you’ll get the payout the broker promised. You can then withdraw your earnings and deposit them into your bank account using any available payment or money transfer methods.

However, if your prediction turns out to be wrong, you’ll lose your investment. In that case, you’ll have to dust yourself off and start over, maybe with a fresh strategy or a clearer understanding of the market.

Binary Options Brokers that accept US Clients

Several brokerages enable binary options trading, but not every brokerage accepts US clients. This is because the US legal landscape for binary options is restrictive and often confusing.

The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) regulate financial trading in the USA. However, the authorities have shown no interest in licensing most online brokers.

Furthermore, there remains a lack of a regulatory framework that allows every brokerage to trade binary options for US traders.

That said, several offshore binary options brokers, some of which are regulated, allow trading binary options for US traders. However, traders in the US must thoroughly investigate every broker they’re considering signing up with. Not every brokerage operates to the highest of standards.

Bearing that in mind, below is a list of tried-and-tested binary options brokers that accept US clients.

Factors to Consider When Choosing a Platform

You can find dozens of binary options platforms online. Some websites are safe and reliable, but many dangerous websites can operate illegally.

Consider how each factor affects your decision when looking for the best binary options trading platform.

Investment assets

In binary options trading, the underlying asset is the financial instrument you invest in. Most trading platforms offer a variety of underlying assets. Some of the most common markets are cryptocurrencies, commodities, foreign exchange, indices, and stocks.

If you have a specific underlying asset, look for a broker specialising in your favourite area. This will allow you to fully take advantage of the platform’s dozens of products.

Maximum fee

Some binary options brokers limit the amount that can be withdrawn from each payment, such as $1,000 or $10,000. The maximum payout is only 85% or 90% of the total return, as other brokers take commissions from both payments of the trade.

When looking for the best binary options broker, consider how the best website payments can affect the end result. Some platforms resist low deposits or other benefits, while others take more money than they’re worth.

Minimum Deposit

Binary options brokers usually require a minimum deposit for each trading account. Depending on the platform’s specific policies, this amount can range from a few dollars to hundreds of dollars.

If you are trading binary options for the first time or are unsure if there is a risk of more than $100, look for a website with a lower minimum deposit. However, if you want to pay more, we recommend choosing a platform with a minimum deposit.

In any case, it is best not to force the trading platform to spend more money than you are comfortable with. If your website’s minimum deposit is too high, look for another platform.

Practice (demo) Account

Practice accounts are helpful for users still learning binary options trading information. Many brokers allow you to test binary options trading with virtual currencies by creating a free demo account. You can use this account to see how your choices affect your win or loss, which will help you feel more confident before spending real money.

Practice accounts also allow you to try several binary options brokers before choosing one. Before creating a paid trading account, you can use a demo account to understand better each platform’s details, user interface, technical indicators, and risk management options.

Country Restrictions

Binary options trading is a highly regulated form of investment, and some countries have special rules for citizen participation. Many brokers do not work in the US because of US trade rules. The UK also regulates trading options through the Financial Conduct Authority (FCA).

When looking for the best binary options broker, ensure the trading platform you visit is available in your country. Don’t try to circumvent country restrictions with VPNs, etc., as this can cause problems with the law.

Deposit method

Providing information to your bank or credit card account is risky, and you should always check that the broker uses a secure payment method before proceeding. Binary options brokers must indicate how to deposit, such as credit or debit cards, cryptocurrencies, e-wallets or bank transfers.

When looking for the right broker, consider which payment method suits you. Once you start trading through the platform, check your bank account. An insecure website can initiate unauthorised withdrawals from your account.

Withdrawal speed

When you profit from binary options contracts, you want your money back quickly. Some brokers withdraw cash soon, so you can get your money within 24 hours of expiry. You may have to wait a few days on other websites before earning money.

When searching for the best binary options broker, pay attention to platform withdrawal times. You must find a platform that advertises instant withdrawals to make money quickly.

Trading app

Some brokers offer browser platforms and applications that allow you to trade on various devices. We recommend using a browser-based platform if you plan to do most of your trading on your computer. However, to verify your account anywhere or do business on your mobile device, you must find an iOS and Android-compatible broker.

Should I Use Multiple Brokers to Trade Binary Options?

Creating an account with multiple brokers can be beneficial for several reasons. First, some brokers specialise in certain types of trades. If you plan to trade in various categories, such as short-term trading, call options trading, and binary options, you can create an account for each type of broker.

Using multiple platforms also reduces the risk of losing all your investments simultaneously. If it doesn’t work with a broker, turns out to be a scam, or doesn’t suit your needs, there’s no risk of losing all your money simultaneously.

In addition, some websites offer new users a signing offer to increase their free initial deposit. Creating accounts on multiple sites and distributing money between them can be helpful to take advantage of these bonuses.

However, if you decide to create an account on multiple platforms, make sure you track your activity on each platform. If you can’t remember various expiry dates, you may miss deadlines and lose profits, denying the benefits of using multiple brokers.

Conclusion: Binary trading is legal in the USA

Binary options trading is available in the US and is a straightforward and quick way to earn money, making it famous worldwide. It offers a simple entry point for beginners and a less complex alternative for experienced traders. Binary options brokers enhance this with user-friendly platforms, bonuses, and educational resources.

In the United States, binary options are tightly regulated, ensuring traders’ safety. All listed brokers comply with CFTC regulations and offer a variety of assets, account types, and trading features.

Choosing a regulated broker like Nadex can significantly improve your chances of success. Nadex is known for its reliability, low minimum deposits, and fair commissions. It also offers technical indicators and a demo account, making it a top recommendation for US traders interested in binary options.

Frequently Asked Questions (FAQ)

Are binary options brokers regulated?

Financial industry regulators regulate many binary options brokers. However, there are still many unregulated brokers in the industry. Regulators around the world have slowly caught up with the industry.

Some institutions and organisations have rules. Regulators that play an essential role in the United States include:

• Securities and Exchange Commission (SEC)

• Commodity Futures Trading Commission (CFTC)

Regulatory bodies in countries around the world include:

• Australian Securities and Investments Commission (ASIC)

• UK Financial Supervisory Service (FCA).

• Isle of Man Gambling Supervisory Commission (GSC)

• Cyprus Securities and Exchange Commission (CySEC)

• Malta Gambling Authority (MGA)

Do binary trading sites accept US and UK traders?

Several binary options trading platforms are currently unavailable in the US and UK. Currently, the only broker regulated in the US is Nadex. The US has stricter rules than other countries, making it more difficult for binary brokers to get approved in the US.

One reason US regulations are tighter is that the government has strict laws banning online gambling. Some regulators define binary options trading as a form of gambling. However, some offshore brokers like Pocket Option and RaceOption accept traders worldwide, including in the US and the UK.

Should a beginner trade binary options?

Binary options trading can be a good entry point for beginners exploring the trading market. Its simplicity lies in the straightforward decision-making process: each trade has only two possible outcomes: yes or no. This binary setup makes it easier to understand than more complex trading options.

However, while binary options are less complex, they still carry significant risks. The advantage here is that these risks are more predictable. You know the maximum amount you can lose from the start—it’s never more than what you’ve invested in each trade.

Additionally, many brokers offer educational resources to help beginners understand and navigate the binary options market effectively.

In summary, if you’re new to trading and prefer a straightforward format with clearly defined risks, binary options might be worth considering.