In binary options trading, pivot points are an essential strategy for identifying potential support and resistance levels and making profitable trades based on market direction predictions. This article provides a comprehensive overview of the pivot point strategy in binary options trading, highlighting its importance in predicting market trends and price movements.

Good to know:

- Pivot points are technical indicators used to predict market trends and price movements in binary options trading.

- They are calculated using the previous session’s high, low, and close prices and can be adjusted for different time frames.

- A price above a pivot point suggests a bullish market, while below indicates a bearish market.

- Pivot points serve as a short-term indicator and are used to determine potential support and resistance levels in intraday trading.

What is the Pivot Points Strategy for Binary Options?

What you will read in this Post

The Pivot Points strategy for binary options is a popular method used by traders to determine potential support and resistance levels in the market. This technique involves calculating pivot points based on the average of the high, low, and closing prices from the previous trading session. Traders then use these points to predict future market movements, identifying potential entry and exit points for their trades.

It is particularly effective in binary options trading, where accurate predictions of price direction are crucial. When the price of an asset trades above a pivot point, it often indicates a bullish market trend, whereas trading below a pivot point suggests a bearish trend.

By combining this strategy with other indicators and market analysis, you can make informed decisions and potentially increase your chances of profitability.

Strategic Use of Pivot Points in Binary Options

Once you’ve created the pivot points, you can use them to help a trader predict how the price of an asset will move. If the cost of an asset trades just above the pivot point, it is usually believed that the market for that asset is trending up. If the cost of an asset falls below the pivot point, the market is said to be trending towards a bearish market.

In binary options trading, knowing the direction of the price movement is crucial and predicting the price movement correctly can help a trader make a large profit in a short period of time.

One of the most difficult aspects of trading is judging whether prices will reverse or continue in their current direction. Although it cannot be described as simple, it is vital to understand as it can be used as a guide when using various methods in both spot forex and binary options. Various indicators have been developed, along with a description of resistance and support level analysis, to help traders determine the pattern of price movements more accurately.

However, it can’t be denied that even when using indicators, subjective considerations play a role in identifying support and resistance levels.

Traders must be careful when using indicators to define their own swing low and swing high or support and resistance levels. But fear not, there are more quantitative indicators available, in particular Pivot Points. This pivot point signal is also suitable for binary options traders.

Extraordinary risks may be difficult, but if you analyse your risks, the binary options approach becomes much more effective.

In this sense, the pivot point and its variants are a tool designed to provide established levels of support and resistance while reducing risk. When used in conjunction with pivot points, good old-fashioned technical tools have been shown to work better in the best binary options approaches than when used alone.

Mastering Pivot Points for accurate price direction prediction

Now, let us take a closer look at how to master pivot points for accurate price direction prediction, as having the correct price direction predictions is essential to binary options trading performance. If a trader can correctly predict where the price is going, he is almost certain to make a profitable trade.

Pivot points are trading indicators that are useful for determining market movements over a period of time. They’re usually calculated by taking the previous trading session’s daily highs and lows, as well as the daily close of the selected asset. By looking at several past time frames, the pivot points can be changed. The hourly chart shows data from the previous hour, while the weekly chart shows data from the previous week, and so on.

Support and resistance levels and Pivot Points

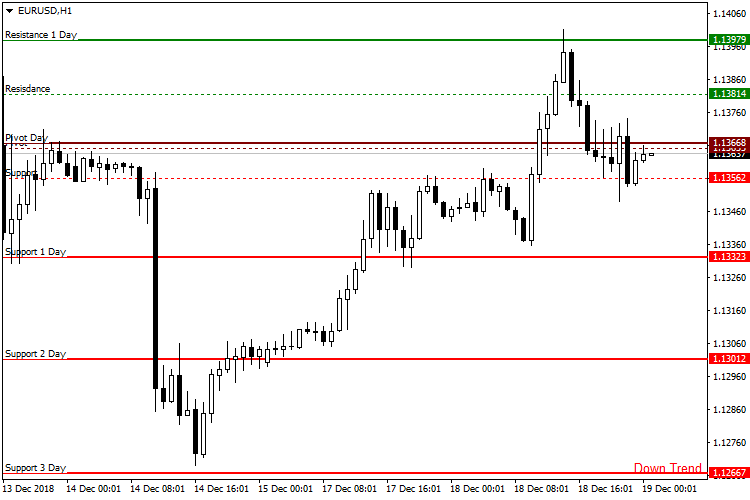

Pivot points can be used to indicate resistance and support levels, for example. The levels of support and resistance can often be estimated by using the price level of the pivot and then measuring the gap between the high and low prices of the previous session.

Suppose the price breaks through one of these areas, either to the upside or to the downside. In this case, the next support and resistance levels must be determined by calculating the price distance between the low and high of the previous session, with an upward break of the preliminary resistance or support level attempting to target the additional level of resistance or support.

Why use Pivot Points?

There are four reasons why binary options traders utilize pivot points:

- Firstly, pivot points have a simple method of calculation.

- Secondly, the points generated from pivot point trade estimates may be placed on a variety of tool charts, including forex, equities, commodities, binary options, and other tradeable capital assets.

- The third reason to use a pivot point is that it provides a great degree of precision. This is why pivot points are so popular among traders. Traders’ expectations for the reliability of the trading indicators provided are nearly always met.

- Fourth, in the price movement technique, the pivot point is the most important signal. In comparison to the MA (Moving Averages) signal, the pivot point trade reacts faster to movement since traders simply need to predict if the price will rebound or break through the indicator’s level. The MA, on the other hand, is dependent on pricing decisions over 5, 10, or 30 days; thus, it will be behind or lagging in current market moves.

Short-term indicator: Pivot Points

While pivot points are a valuable tool for determining the direction of the market, it’s important to remember that they are often used as a short-term indicator. This means that it’s important to keep all trades on a constant time frame, as the period after that makes price movement more difficult to anticipate. Pivot points are great indicators to help a trader decide where to place a put or call trade if this guideline is followed.

Pivots for binary trading strategy calculation

You may compute Pivot Points for binary tools at any time of day. The rates for the current trading day can be derived using the values from the previous trading day.

Pivot Points are calculated using the following formula:

High (prior) + Low (previous) + Close (previous)/3 = Pivot Point for Current

After you’ve computed the pivot points, you may use them to determine the trading day’s support and resistance levels.

Calculating pivot points may be accomplished in several methods. Traders may now use a pivot point calculator to compute pivot points thanks to advancements in technology instantly.

Majorly, the following are the formulas that traders can use to calculate the pivot points:

- Pivot Point (PP): (high + close + low) / 3

- Resistance 1 (R1): (2 x PP) – low

- Support 3 (S3): low – 2 x (high – PP)

- Support 1 (S1): (2 x PP) – high

- Resistance 3 (R3): high + 2 x (PP-low)

- Resistance 2 (R2): PP + (high – low)

- Support 2 (S2): PP – (high – low)

Where

- high: highest price

- close: closing price

- low: lowest price

The level of the price at the end of the prior period is used to calculate the highest, lowest, and closing prices. This is determined by the period in use by traders. If a trader looks at the daily chart, the cost from the preceding day is used. Similarly, to the once-a-week time frame, the trader will use the prior week’s price accomplishment.

Which Pivot Points are best for intraday trading?

One of the popular trading styles that are heavily dependent on pivot points is one-day trading or intraday. This is because pivot point trading typically involves methods that allow intraday traders to enter and exit transactions inside a single day.

However, there are several ways to calculate forex pivot points. Each technique has its own set of entry points and levels. Naturally, the question arises: what are the ideal pivot positions for intraday trading? In this post, we’ll attempt to address that question.

Methods for Calculating Pivot Points

There are five main ways of calculating pivot points. The Classic, Woodie, Camarilla, Fibonacci, and Central Pivot Ranges are among them (CPR).

And they all have one common factor: they calculate support and levels of resistance using the high, low, and closing prices of the previous trading sessions.

Classic Pivot Points

Consider the traditional pivot point, for example.

It all begins with the fundamental pivot point (PP). The PP then serves as the foundation for all subsequent pivot levels.

- Basic Pivot Point (PP) = (High + Low + Close) / 3

- Resistance 2 (R2) = PP + (High – Low)

- Support 2 (S2) = PP – (High – Low)

- Resistance 1 (R1) = (2 x PP) – Low

- Support 1 (S1) = (2 x PP) – High

- Resistance 3 (R3) = High + 2 (PP – Low)

- Support 3 (S3) = Low – 2 (High – PP)

The most effective Pivot Point for intraday trading

There is no single pivot point that is unquestionably the greatest for intraday trading. What we have here is a pivot point that will work better for you than for other intraday traders. It all comes down to personal choice.

If you want to make a lot of trades every day, you could choose the Camarilla and CPR pivot points. These calculation techniques result in more pivot lines. And the greater the number of pivot lines, the greater the number of trading opportunities. The downside of this type of active trading is that you will have to be content with making a few pennies at a time.

For example, R1 and R2 in the Camarilla calculation technique may only be 10 to 15 pips apart.

And depending on how wide your broker’s spreads are, your losses and gains will generally be smaller than that. However, because you will be making multiple trades throughout the day, you may accumulate profits or losses after the trading day.

However, if you’re an intraday trader who only makes one or two trades per session, the traditional Woodie and Fibonacci pivot point trading may be more suitable for your trading strategy. These two approaches rarely produce as many pivot lines as the other.

There are also occasions when R3 and S3 are nowhere to be found. As a result, there are fewer trading opportunities. However, the pivot lines tend to be further apart, leaving more pips between pivot points.

Best Pivot Point trading strategies for intraday trading

The resistance and support levels for the five pivot point calculating techniques differ. This might act as the foundation for creating a trading method based on pivot points. For example, the R1 of the Fibonacci pivot point may be at one position, whereas the R1 of the Classic pivot point trade could be in a separate one.

And, in most cases, the variance between these two R1s is only a few pips. So, using one calculating technique, you can get a pivot line scratching the top of a candlestick, but using another, you can see a difference between both the top and the light of the candlestick.

So you get to pick how near your resistance level, and support should be to your candlesticks.

There are popular trading techniques that you may wish to follow regardless of the calculating technique you choose. Here are a few among the most effective intraday trading techniques that make use of pivot points.

- Intraday Trading Strategy Using Pivot Points Breakouts

The goal of this trading technique is to trade cost breakouts around pivot lines. Whenever the price goes above a resistance pivot line, you purchase, and once the price reaches below the support line, you sell.

Typically, the best approach to forecast a day’s price bias is to see if the stock begins above or below the fundamental pivot point trade (PP). A break lower than the PP indicates a bearish bias, while a breakout above indicates a bullish bias.

Watch for breakouts over your resistance pivot lines if you have a bullish inclination. In contrast, if you have a bearish inclination, you should seek breakouts lower than the support lines.’

But, you do not always need to follow this principle because the price may begin with a bullish bias and conclude the day less than its beginning point. To compensate, you may trade breakouts of resistance and support lines regardless of bias. Nevertheless, because you would be trading as opposed to the bias, this may considerably raise the risks.

- Intraday Trading Strategy Using Pivot Point Bounce

The pivot point bounce technique is based on the pivot lines’ capacity to act as pivotal price moments. Whenever the price moves towards the line and comes back in the prior position, it’s time to enter a trade on that path.

Is Pivot Point strategy a good Binary Options strategy?

The pivot point is great for binary options. The essential factor to know when employing a pivot point approach for binary options would be that price movement changes are not fixed. In other terms, no inherent rules govern the cost of an asset depending on its pivot points or resistance or support levels.

Every day, pivot points are passed without significant price movement; support levels degrade, while resistance levels might break as an asset resumes its bullish run. The sole principle is that there are no principles.

However, since pivot point trades are useful and dependable, experienced traders are learning to employ them. They are quite precise and simple to compute and are an important tool for technical indicators. If you aren’t already relying on them for your binary options trading plan, now is an excellent time to begin.

Pivot points are a common technique in the market’s technical analysis and may be utilized in a variety of trading situations. Learning how to determine pivot points and how they may assist you in acquiring binary options will provide you with another instrument to enable you to become lucrative.

Why should you trade Pivot Points with Binary Options?

Binary options offer the advantage of calculable risk and a high potential return. The maximum loss is usually limited to the amount bet. This means that there are no larger losses than expected, which can occur when trading or Forex CFDs with poor execution (slippage). Most binary options companies also offer loss insurance, which means that if the contract expires out of the money, up to 15% of the capital will be returned.

Because settlement is usually determined at the end of the period, binary options have an inherent tolerance for error. Price changes during the period are usually irrelevant. As a result, there is no way to exit the trade and time is less important than in Forex or CFD trading.

For example, if a binary options trader chooses to buy a call at support S1 with a time horizon of several hours, the price may fall to support S2 in the meantime without causing an immediate loss. If the price of the underlying asset turns at the pivot point S2 and is just one click higher at the end of the period than at the beginning, the trader will make the predetermined profit.

The main reason why pivot points are a popular forecasting technique among traders is that the data they provide is accurate for the whole day, so no effort or time is spent on calculation. Depending on how the data is used, pivot point trading can be set on a monthly, weekly or daily basis.

Furthermore, because support or resistance levels are easy to grasp and can be displayed graphically on a chart, traders find pivot points easy to understand and beneficial, especially when trading options with a short time to expiry.

The advantages of using Binary Pivot Points

Take the currency pair EUR/USD and build a statistical tool demonstrating how far off every low and high will be from each resistance and support level to have a clearer understanding of why pivot points are important binary options techniques.

Calculate yourself

- Conduct a comprehensive analysis by calculating total pivot points and also support levels and resistance for the entire amount of days in the discussion.

- Reduce support point levels from the true least point of a trading day. (Low-S)

- Remove pivot points for resistance from the true high. (High-R)

- Next, compute the mean of every difference.

To further comprehend Pivot Points as a Top Binary Options Strategy, consider the record of the Euro ever since its creation on January 4, 1999.

- On average, the real low is one pip lower than Support 1.

- In general, the real high is one pip lower than Resistance 1.

For the second degree of support and resistance:

- The real bottom is usually 53 pips higher than Support 2.

- The actual peak is usually 53 pips lower than Resistance 2.

Since it encourages a systematic strategy to binary options trading, the notion of Pivot Points is ideal for usage as a Binary Options method. Binary options get the ability to produce significant rewards while posing a manageable risk. Pivot Points give well-defined points of entry into the marketplace with a high likelihood of success.

As a result, Binary Options and Pivot Points make an excellent, lucrative symbiotic relationship for impulsive yet strategically-minded traders. Traders, particularly in the binary options market, might begin with extremely tiny trading accounts, resulting in a shortage of strategic know-how in conjunction with trading cash.

Conclusion – The pivot point strategy is useful for binary options trading

In conclusion, the pivot idea is a useful tactic for new traders to organise their trading and increase their chances of long-term success.

As you become more experienced with binary options trading, you may see market trends that reinforce these pivot point trades. You will begin to improve your ability to predict when is the optimum time to enter options and what assets are best used with this investment approach.

As with most other binary options trading techniques, there is no one pivot point that is superior to another. It all depends on your choices.

Frequently asked questions about Pivot points:

What are pivot points in binary options trading?

Pivot points are technical indicators used to predict market trends and price movements by using the previous session’s high, low, and close prices.

How are pivot points calculated in binary options trading?

They are calculated by taking the average of the high, low, and closing prices from the previous trading session.

Why are pivot points important in binary options trading?

Pivot points are crucial for identifying potential support and resistance levels, helping traders make informed decisions about market direction and profitable trades.

Can pivot points be adjusted for different time frames?

Yes, pivot points can be adjusted to suit different time frames, from hourly to weekly charts, offering flexibility in trading strategies.