In this easy-to-follow guide, we’ll explore the Commodity Channel Index (CCI), explaining its definition, how it’s calculated, and how to use it in Binary Options trading.

We’ll also explore its pros and cons, compare it with popular tools like the MACD, RSI, and Bollinger Bands, and walk you through some exciting CCI strategies to boost your trading game!

What is the CCI Indicator?

Developed by Donald Lambert, a renowned technical analyst, in 1980, the Commodity Channel Index (CCI) is a technical analysis indicator used to identify new trends or warn of extreme conditions in a specific asset.

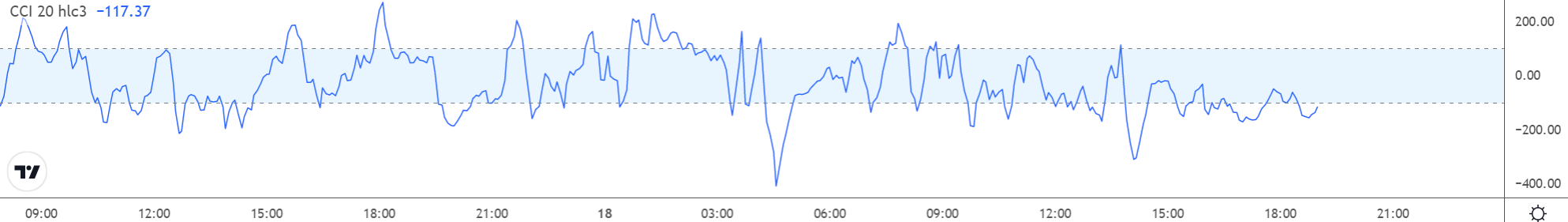

Moreover, CCI is categorized as an “Oscillator,” a type of indicator that moves between two opposing values to indicate “overbought” and “oversold” levels.

CCI can serve as both a lagging and leading indicator. As a lagging indicator, it is mainly used to ” confirm ” a price trend, demonstrating the strength or weakness of a price movement within a specific timeframe.

Conversely, as a leading indicator, CCI can identify “bullish divergence” (when the price is falling, yet CCI starts to move upwards) and “bearish divergence” (when the price is rallying and CCI starts to slope downwards).

Key Facts About CCI Indicator Trading Strategy:

- The Commodity Channel Index (CCI) was created in 1980 by Donald Lambert to identify new trends and extreme conditions in assets

- CCI can act as both a lagging indicator for trend confirmation and a leading indicator for predicting price reversals

- CCI doesn’t have fixed boundaries, making it highly adaptable for analyzing volatile markets and assets

- Combining CCI with indicators like RSI or MACD can reduce false signals and enhance the accuracy of your binary options trades

How Is The CCI Indicator Calculated?

| CCI = (Typical Price – Simple Moving Average) / (1.5% x Mean Deviation) |

Step 1: Calculate the Typical Price for each period:

Typical Price = (H+L+C) / 3

First, the typical price for each period (e.g., a day, an hour, or a minute) is calculated by taking the average of the high (H), low (L), and close (C) prices.

Step 2: Calculate the Simple Moving Average (SMA) of the Typical Prices:

If SMA is 20: Then SMA = (Sum of the last 20 TPs) / 20

Second, the SMA is calculated by averaging the typical prices for a specific period (the default period usually is 20).

Step 3: Calculate the Mean Deviation:

Mean Deviation (D) = (Sum of absolute differences) / 20

Third, the mean deviation is calculated by the average absolute differences between each period’s TP and the SMA (which is 20).

Step 4: Calculate the CCI:

Lastly, as shown in CCI’s formula, the final CCI value is calculated by dividing the difference between the typical price and the 20-period SMA of the typical price by the mean deviation multiplied by a constant (typically 1.5%).

Note: The constant 1.5% ensures that roughly 75% of the CCI values fall between -100 and +100. This scaling factor helps to “normalize” the index across various types of assets and market conditions, making it easier to analyze the CCI values.

How to Trade Binary Options with CCI:

The following are the three simple steps to start utilizing CCI in binary options trading:

Steps 1 and 2: Choose a Trading Platform and add the CCI Indicator

First, you must choose a broker that supports the CCI indicator. Picking a reputable binary options broker is crucial to protect your capital from fraud.

Here are two brokers we recommend, along with background information and instructions on how to access their respective CCI tools.

Pocket Option

Pocket Option is well-known for its easy-to-learn and user-friendly interface on its website and mobile applications, offering a comprehensive range of assets and markets available for trading.

How to Add: Click the “Indicators” logo beside the asset’s name at the top and select “CCI.”

Customization: You can customize the number of periods (set at 20 in the default setting).

Quotex

Quotex is notable for its more advanced offerings, including a wide range of analytical trading tools ideal for more experienced and advanced Forex binary options trading traders.

How to Add: Click the “Indicators” logo at the bottom left portion of the chart and select “CCI.”

Customization: Similar to Pocket Option, you can edit the number of periods.

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

Step 3: Make Your Analysis

Afterward, conduct a comprehensive analysis using the CCI indicator to identify specific trading opportunities across various assets and markets. Remember, there are multiple methods to analyze the binary options-supported asset you have chosen. The following are three relevant CCI analysis-based strategies you can use.

Strategies for the CCI Indicator:

Bullish/Bearish Divergence Strategy

First, you can utilize CCI as a divergence tool to identify potential price reversals. When the CCI is in overbought condition (commonly above +100) or oversold condition (typically below -100), you can use this as a sign that the asset is due for a reversal soon. Then, you wait for a divergence (CCI moves in the opposite direction compared to the price) to confirm that the price will follow CCI’s direction shortly.

Overbought/Oversold Momentum Strategy

Second, you can use CCI to capitalize on an asset’s momentum (or prevailing sentiment). While CCI is useful for identifying overbought and oversold levels where potential reversals can be found, high-momentum assets during specific periods can stay overbought or oversold for an extended span of time. Hence, this strategy banks on “riding” the momentum while it lasts (as long as it is on overbought or oversold levels).

Price Action Confirmation Strategy

Lastly, you can use CCI as a confirmation tool when assessing a specific price action strength or weakness, trend, and patterns. This adds another layer of confidence when evaluating a particular price action movement. For example, you can use CCI when identifying a price reversal pattern to confirm its validity and potentially avoid whipsaws, especially on volatile asset classes.

What Are The Pros and Cons of the CCI Indicator in Binary Options Trading?

- Dynamic ranges

- Reversal and divergence identification

- Additional confirmation tool

- Provides momentum insight

- Enforces discipline

- Timing issue

- Sensitivity to market noise

- Complexity and experience requirement

- Risk of manipulation

- Faulty signals

What Are Alternatives to the CCI Indicator?

Here are some oscillators that can serve as potential alternatives to some of CCI’s compelling functions:

MACD (Moving Average Convergence Divergence) – First, MACD is typically used to measure shifts in the strength, direction, momentum, and duration of a trend in an asset’s price. MACD comprises two moving averages (default setting at 12-day and 26-day averages) and a histogram that gauges the distance between those moving averages.

RSI (Relative Strength Index) – Second, RSI measures the speed and change of price movements from 0 to 100. RSI is also used to identify overbought or oversold conditions where a reading above 70 is considered overbought, while a reading below 30 is deemed oversold.

Bollinger Bands – Lastly, this oscillator also measures market volatility and identifies overbought or oversold conditions. Bollinger Bands consists of a “middle band” being also a moving average (typically the 20-day moving average) and two “outer bands” (viewed as standard deviations) away from the middle band.

Can You Combine the CCI with Other Indicators?

As observed, MACD, RSI, and Bollinger Bands indicators seemingly have an overlapping purpose with CCI and may be deemed as “redundant” or “unnecessary” when trading. Yet, you can actually combine CCI with these indicators to enhance the accuracy and reliability of your analysis, filter out market noise, and better time your binary options trade entries.

You can start by combining CCI with another oscillator, such as RSI, to potentially prevent false signals and see how and when their results differ to better identify potential specific use cases.

Note: Mindlessly combining these indicators can lead to “Analysis Paralysis” caused by information overload. Hence, studying and testing these oscillators is crucial to pinpoint synergies and market applicability you can use to your specific trading system.

Conclusion

With all these factors considered, the Commodity Channel Index — despite its name — can be applied across any asset class and in multiple timeframes. Its value proposition of identifying momentum strength or weakness and providing an added layer of confirmation during divergences and reversals is extremely valuable in binary options trading.

Nevertheless, like any other indicator, it is imperfect and can deliver incorrect signals or be misinterpreted if not appropriately studied. Thus, it is essential to conduct your due diligence in learning and testing how this indicator functions before using it in an actual trade environment.

Most commonly asked questions about CCI indicator in Binary Options Trading:

What is the Commodity Channel Index (CCI)?

The Commodity Channel Index (CCI) is a technical analysis indicator used to identify new trends or warn of extreme conditions in a specific asset. It can also identify overbought and oversold market levels, gauge the strength of price movements, and signal possible trend reversals.

Can CCI be used for all asset classes in binary options trading?

Yes, despite its name suggesting it can only be used for commodities, the CCI can also be used for any asset class and market that binary options support, including stocks, indices, currency pairs, and cryptocurrencies, across various timeframes.

What do CCI values mean?

Generally, CCI values above +100 suggest an asset is overbought, while values below -100 indicate an asset is oversold. However, unlike other oscillators, the CCI has no fixed upper and lower boundaries. This characteristic allows it to reflect better the behavior of volatile assets or market environments, e.g., in the +200 and -200 regions.

What is a CCI divergence, and how can it be used in binary options trading?

CCI divergence occurs when the CCI moves in the opposite direction from the price. This divergence can signal a potential trend reversal. It may be used as a basis for making entry decisions in binary options trading, with the expectation that the price will soon follow the direction indicated by the CCI.

How does the time frame selection affect the CCI in binary options trading?

In general, the time frame affects the sensitivity and frequency of the signals generated by the CCI. Shorter time frames will produce more overbought and oversold signals with increased sensitivity, which may lead to more false positives. Conversely, longer time frames will generate fewer signals, potentially leading to delayed entries — since binary options trading is fast-paced — but generally offering higher reliability.