Opening a Deriv Trading account is one of the most effective ways to begin trading in the binary options market. It is vital for newcomers who are trading for the first.

The demo account is quite comparable to a real account in terms of functionality, with the exception that traders utilize virtual money. Traders should practice on a demo account to gain expertise with all trading capabilities.

The demo account is the appearance to commence your trading expedition, and Deriv Trading brings you and fortuity to do so.

(RIsk warning: Your capital can be at risk)

What you will read in this Post

What is Deriv trading demo account?

The starters normally tussle to create and execute their trading judgment. However, the task becomes much smoother with a demo account.

Similarly, the other trading platform, Deriv Trading, considers its user to begin their trading expedition with a demo account. A Deriv account lets you exercise with the trading platform before you are distinct to put money into the same real money.

The finest feature is that traders obtain virtual money, and there is no requirement for a minimum deposit on Deriv or having any real funds on the account.

The only difference between a Deriv demo account and a live trading account is that you do not use real money to buy or sell assets. You can imagine the demo account as a real account where you can test your trading comprehension.

(RIsk warning: Your capital can be at risk)

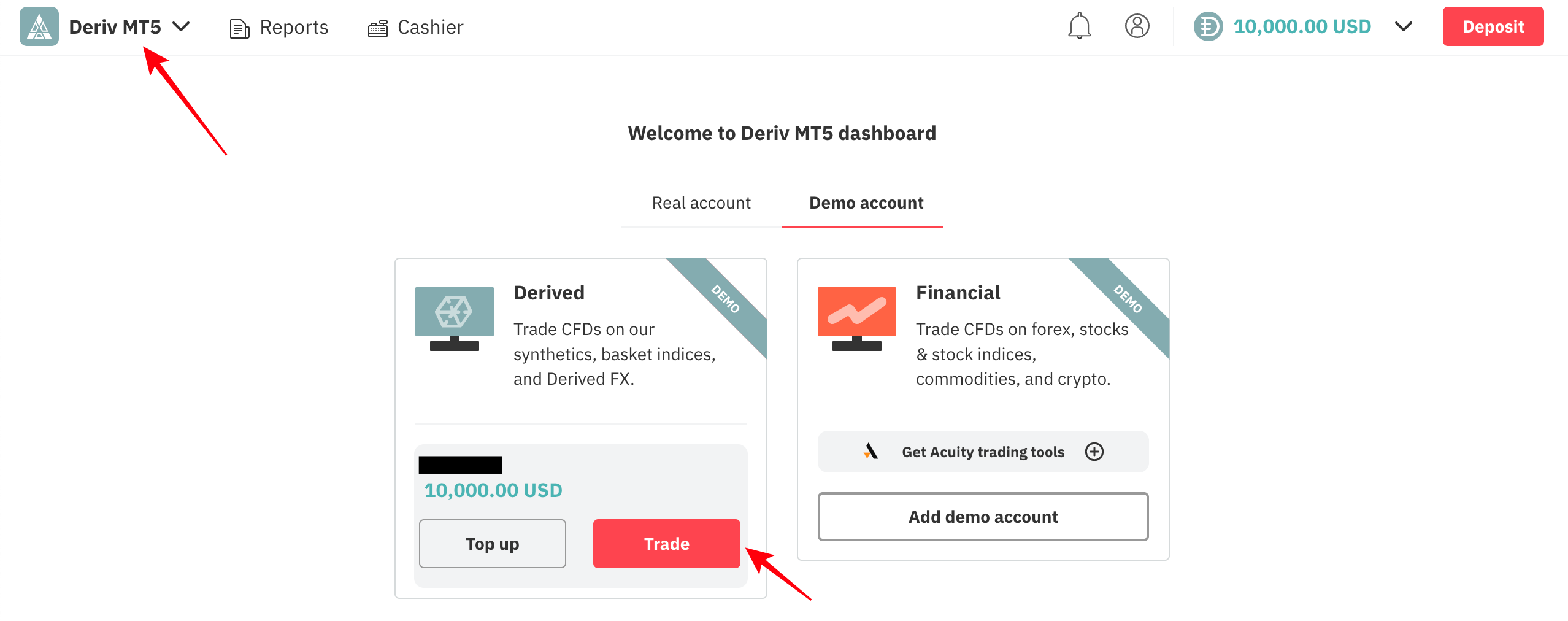

Getting started with the Deriv trading demo account

Traders must first find the deriv.com website and then go to the page with the numerous account options.

When you click on the demo account, traders will be asked to fill out an application or sign up for an account, which will require their email address. Traders can also utilize Facebook or emails to activate their demo account, which will include a link. The Deriv registration is also possible with a demo account.

Finally, traders can take advantage of the platform’s demo account.

(RIsk warning: Your capital can be at risk)

How to use the demo account?

Applying for a demo account is simple, especially when the trader gives you a user-friendly alliance. On the other hand, a trader can deal gutsily with a demo account because it implies only unreal money when signing up for a demo trading account.

Choose your favorite asset to use the Deriv platform. Purchase those assets, watch for the trends, apply the technical signals, and other obtainable implementations on the online trading platform.

Why beginners need to have an online trading demo account

Online trading can be confusing, especially for beginners. There are several trading terminologies to master, a diverse range of markets and items to comprehend, and of course, a trading technique that will work for you. An online trading demo account can help you work through the basics in a risk-free environment.

It allows you to familiarise yourself with different trading platforms and enables you to practice trading skills and strategies using virtual funds.

You can create a demo account on all of Deriv’s trading platforms. You can get started with any virtual amount of money, which you can top up any time you run out.

You will be able to open positions on your preferred trading platform to get a good group of how it works and explore the available assets to trade.

You can use a demo account to help you with various areas of trading, such as:

- The importance of risk management

- In-depth market analysis

- Developing a plan

- You have found a winning strategy

- You manage your emotions more effectively

- Establishing strategies to avoid losses on Deriv

- Taking an overview of the platform and seeing how the verification on Deriv works

Don’t get too worried or panic if some of your trades don’t go well. After the disappointment, take a break and let your emotions settle. Don’t get too excited after a win, either. If you fill like you are on a winning streak, you may be impulsive and open additional positions. Part of becoming a great trader is being able to distance yourself from your deals.

(RIsk warning: Your capital can be at risk)

Features of the demo account

All you have to do is open a position that forecasts how the asset will move over time. This assembles it workable for the public to cooperate in the financial market with formal capital expenditure.

On Deriv, you can trade the following options:

- Digital options: These let you anticipate the outcome from a set of possible outcomes and receive a preset dividend if you are accurate.

- Look backs: These allow you to earn a reward based on the market’s best high or low during the term of a contract.

- Call/Put spreads: These allow you to earn up to a certain amount based on where the exit location is in relation to the two separate barriers.

- Predictable, fixed payout: you’ll know your possible profit or loss even before you buy a contract.

- All of your favorite markets, plus more: Trade on all major markets as well as our exclusive synthetic indexes, which are available around the clock.

- Instant access: Create an account in minutes and begin trading.

- Easy-to-use platforms with robust chart widgets: Trade with the safe and secure broker Deriv. It is a straightforward, and simple platform with advanced charting technology.

(RIsk warning: Your capital can be at risk)

Options to trade on Deriv

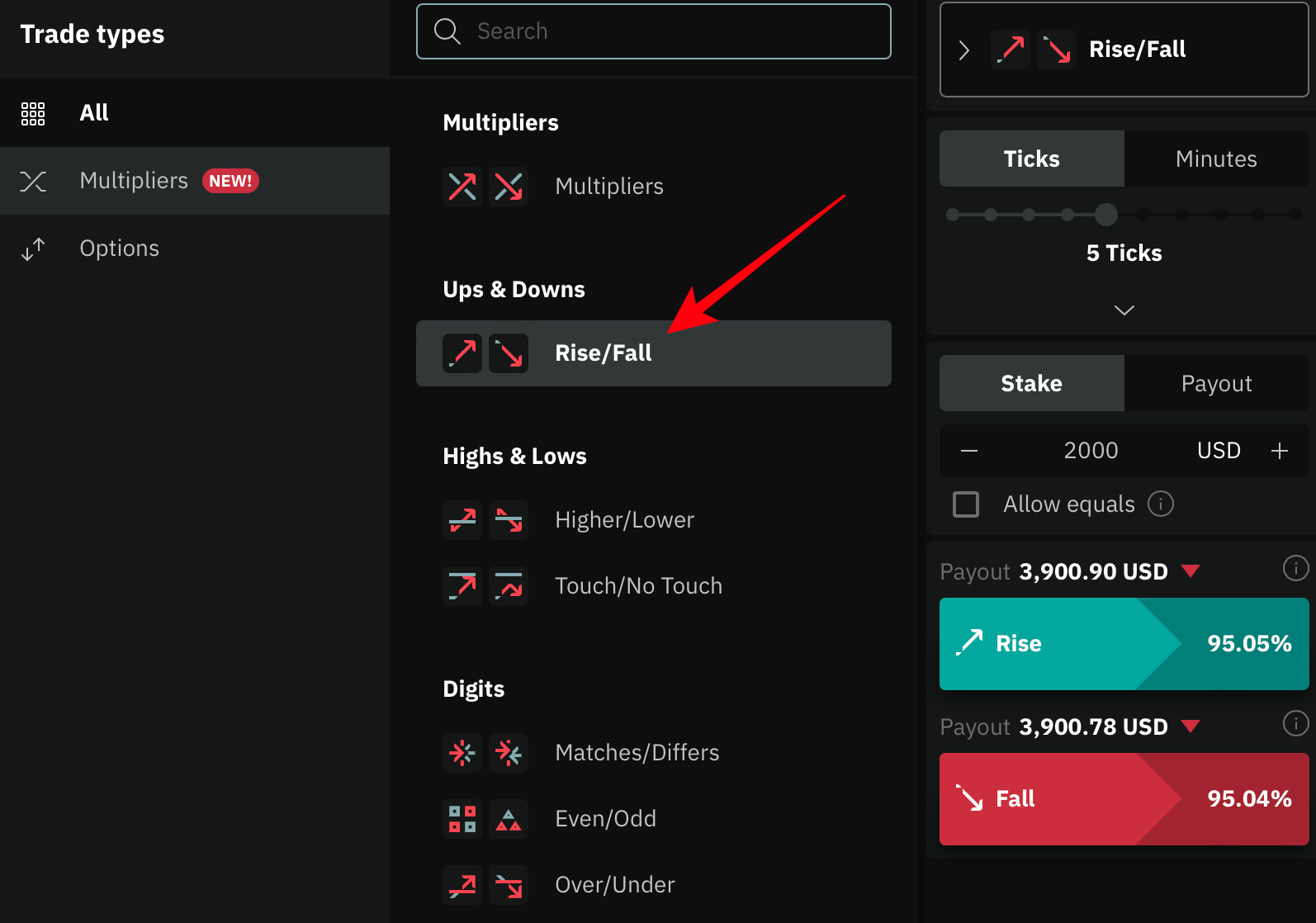

Rise/Fall

Discover if the exit line is closely larger or lower than the set foot in place at the end of the agreement hour.

If you choose ‘Higher,’ the payment is yours if the departure place is exactly the same as the entering spot. If you choose ‘Lower,’ you will win if the departure point is exactly lower than the entering spot.

Ends between/ends outside

If you select ‘Ends between,’ you will get if your exit line is closed higher than the low limit and lower than the high limit.

Matches/Differs

If you select ‘even,’ you will get it the last number of the previous market is an even number. If you select ‘odd,’ you will get if the last number of the previous marker is an odd number.

Even/Odd

Determine if the last tick of a contract will have an even or odd digit.

If you choose ‘Even,’ you will win if the final digit of the previous tick is an even number. If you choose ‘Odd,’ you’ll win if the final digit of the previous tick is an odd number.

High-Low

When you buy a ‘High-Low’ contract, your win or loss is determined by multiplying the multiplier by the difference between the high and low throughout the contract’s lifetime.

High-Close

When you buy a ‘High-Closing’ contract, multiply the multiplier by the difference between the contract’s high and closing durations to determine your win or loss.

Close-Low

When you buy a ‘Close-Low’ contract, your win or loss is determined by multiplying the multiplier by the difference between the close and the low during the contract’s life.

Conclusion – Practice trading on the demo account

A demo trading account can open the door to possibilities for beginners and advanced traders. Starters can depart from their anxieties about being at a loss when starting their trading career. Trading at the back of a demo trading account is peaceful for beginners.

(RIsk warning: Your capital can be at risk)