At the money (ATM) is a Binary Options term that describes a situation where the strike price of an asset is equal to its current market price.

It is also known as “on the money,” which is a situation where traders do not profit or lose money from the trade. The invested amount in the Binary Option will be credited back to the account balance.

At The Money (ATM) in Binary Options in a nutshell

- A scenario where the asset’s strike price equals its current market price.

- If the strike price matches the market price, the intrinsic value is zero — no gains or losses, only a remaining time value.

- Benefits: Limited risk and the potential for significant profits.

- Implied volatility tends to be lowest at or near the money, influencing option prices.

What happens when market price meets strike price?

When an asset’s strike price and current market price are the same, its intrinsic value becomes zero. Meaning, there would be no gain or loss by buying or selling the asset.

While the intrinsic value is zero, the asset still has a time value. That’s why, at the expiry time, the value of an asset can be either out of the money or in the money.

How does “At The Money” work?

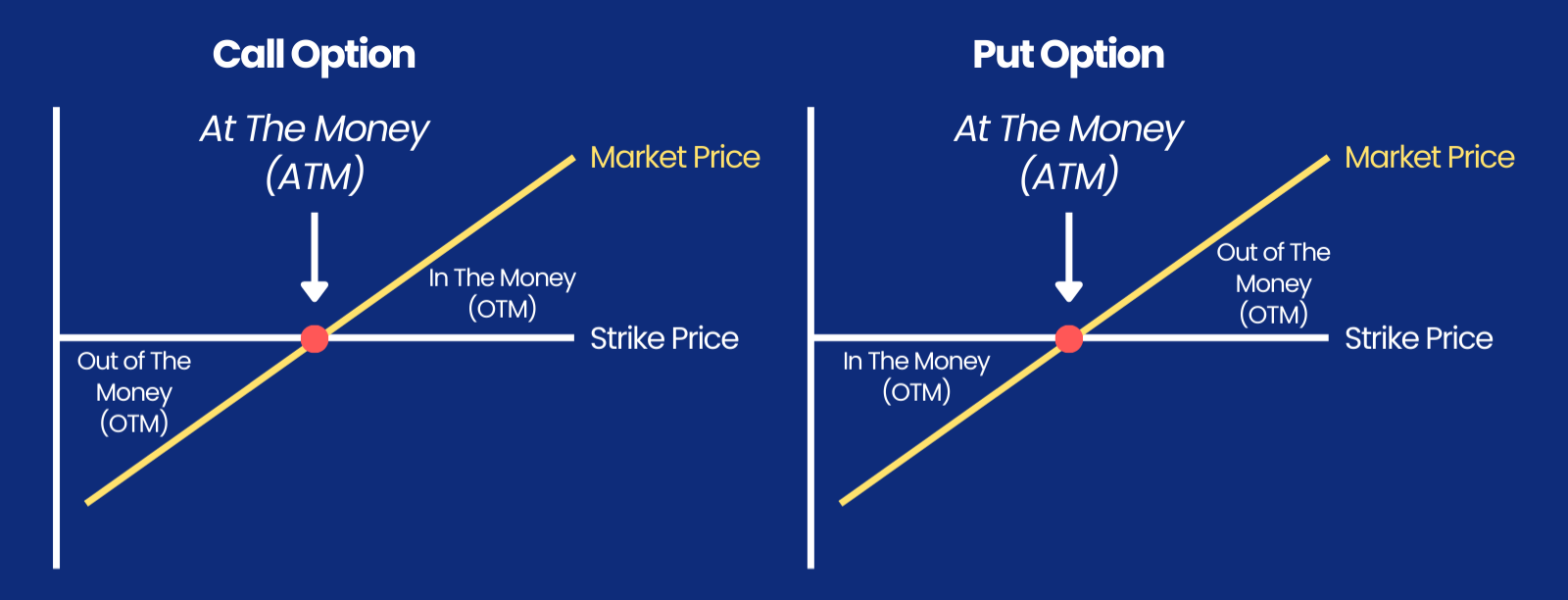

To understand the “at the money” situation, here’s a small example, how it works. Let’s say the current price of gold is $1500 per ounce. If When you place a binary option trade where you predict that the price of gold will be exactly $1500 at expiration, you are basically targeting an “at the money” outcome.

In this scenario, if the price of gold settles at $1500 when the option expires, you will have neither won nor lost, but basically broken even. If the price of gold moves even slightly from $1500, you would either make a profit or suffer a loss, depending on whether your prediction was correct.

If you place a binary option trade where you predict that the price of gold will be above $1500 at expiration, and it actually settles at, say, $1520, your trade is considered “in the money“. That means your prediction was correct and you will receive a predetermined payout.

On the other hand, if you predicted a price above $1500, but the price settles below, say, $1480, your trade is considered “out of the money“. In this case, you would lose your initial investment.

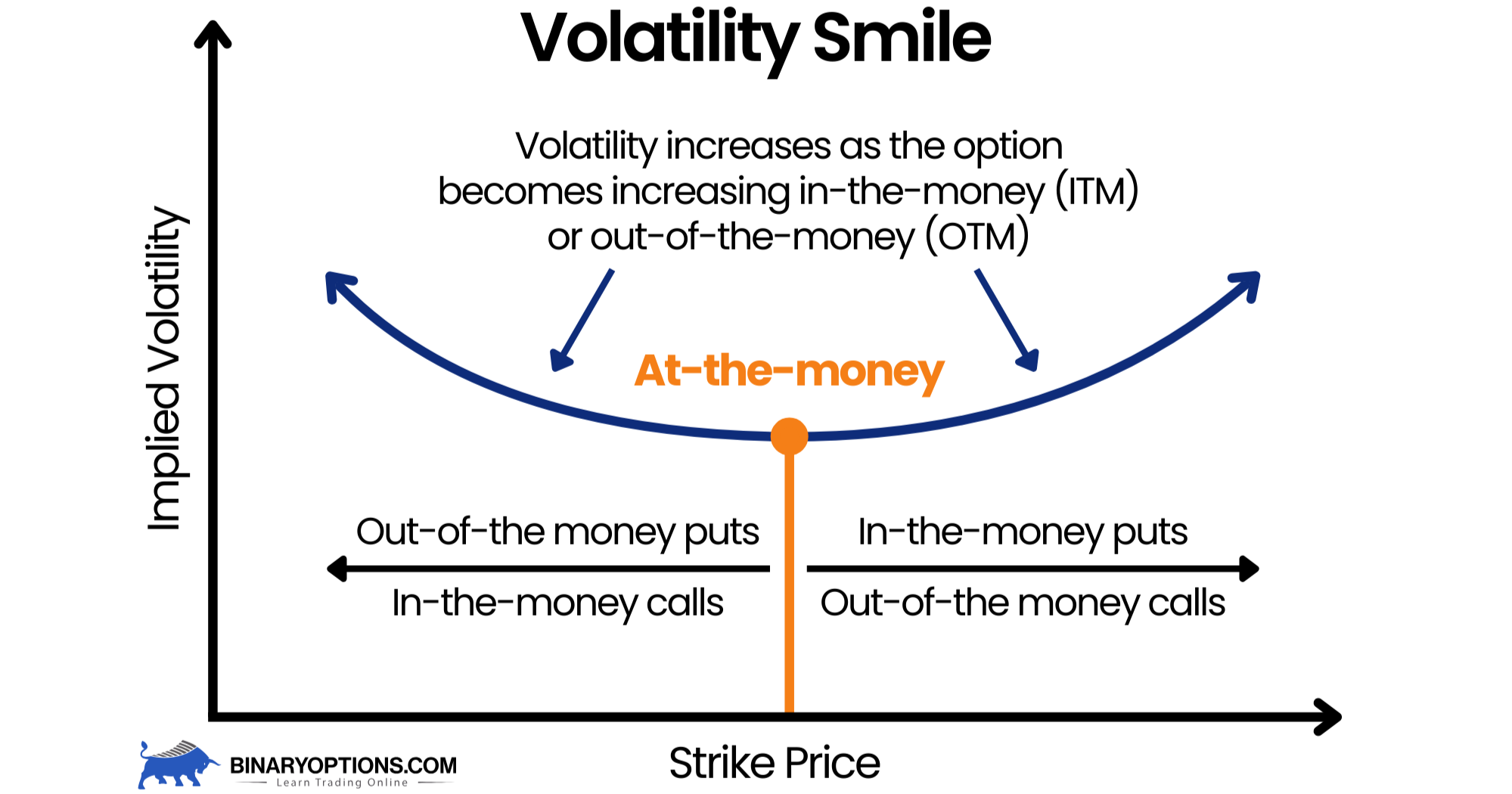

Is there a relationship between At The Money Options and the Volatility Smile?

Yes, there is a relationship. The implied volatility is usually lowest when the options are at or near the money, but increases as the options move away from this point, creating a U-shaped curve known as a “volatility smile“. Sometimes a skew or smirk can be seen, which indicates higher volatility in options that are further in or out of the money.

An implied volatility has a significant impact on option prices and usually results in higher prices for in-the-money and out-of-the-money options compared to at-the-money options with similar characteristics.

What are the Benefits of At The Money Options?

ATM (At The Money) options have a number of advantages for traders, such as higher liquidity and low premium costs. Here you can find out why they are worth considering:

- Higher liquidity: ATM options offer higher liquidity and tighter bid-ask spreads compared to other options, making it possible to enter and exit positions quickly.

- Low premium costs: Typically, ATM options have lower premium costs than out-of-the-money options and offer traders a more favorable risk/reward ratio.

- Trading strategy flexibility: Trading ATM options can be used for different strategies such as Straddles and Butterflies.

- Hedging instruments: ATM options allow traders to protect themselves from market losses by offsetting the time and value of the option.

When do At The Money, In The Money, and Out Of The Money matter in binary options?

In binary options trading, each commodity price falls into one of three categories: “at the money”, “in the money”, or “out of the money”. Understanding these terms is key, as they guide whether to choose a call or put option based on market analysis.