Yes, binary options trading is legal in Mexico.

Trading in binary options is subject to oversight and regulation by the National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores), ensuring that all financial operations adhere to legal and regulatory frameworks.

With proper regulation, binary options trading operates as a legitimate and accessible financial activity in the country. However, traders should still take precautions before engaging in the activity, as it involves financial risks.

Let’s find out how to trade binary options in Mexico in the step-by-step guide below.

Key facts about Binary Trading in Mexico

- Binary options trading is legal in Mexico, and there are no specific regulations that restrict it.

- Mexican traders can start to trade binary options with a low minimum deposit of $10

- Different brokers offering high returns, such as Pocket Option or Quotex, are available.

- Binary brokers in Mexico support local payment methods.

A Step-by-Step Guide to Trading Binary Options in Mexico

If you’re new to binary options trading in Mexico, thoroughly understanding the trading process is essential. Binary options offer traders a potentially profitable endeavour when approached with the proper knowledge and strategy tailored for the Mexican market. Our step-by-step guide is designed to help new traders in Mexico, ensuring they can execute trades effectively.

1. Pick an available binary options broker in Mexico

Binary options trading is not always available in all countries.

This means that traders from certain nations may not be able to buy or sell binary options with a local broker and must instead seek an offshore broker authorised by a reputable body.

Engaging with a licensed broker is crucial to ensure your safety. A licensed broker will offer you a fair price unaffected by market manipulation, ensuring your capital is not in danger. Binary options traders based in Mexico can use any of the following brokers:

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

from $ 5

(Risk warning: Trading is risky)

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

from $10

(Risk warning: Trading is risky)

Quotex

Quotex is a legal trading platform in Mexico. A well-known brokerage prioritising customer experience, Quotex is a prominent service for trading options and derivatives. It has a reputation for creating infrastructure and was a market innovator for binary options and contracts for differences backed by Bitcoin and other cryptocurrencies.

Quotex offers a variety of trading options, including forex, stocks, indices, and commodities such as oil and silver. It also allows traders to trade four popular cryptocurrencies: Ethereum, Litecoin, Ripple, and Bitcoin.

Features

- Minimum Deposit: $10

- Account Types: Demo, Live

- Trading Platform: Web platform & Mobile platform

- Instruments: Currency pairs, commodities, indices, and Tradeocurrencies

- Minimum Trade: $1

- Expiry Times: 1 minute to 4 hours

(Risk Warning: Your capital can be at risk.)

Pocket Option

Pocket Option is a legal trading platform in Mexico—one of the earliest platforms with a dedicated app for tracking trades. It is based in Costa Rica. It holds a valid brokerage license from the Autonomous Island of Mwali, making it a safe brokerage binary options traders can rely on. Over time, it has developed a reputation as a major player in the financial industry and currently ranks among the top three binary options brokerages.

Pocket Option offers the broadest range of trading options. The site offers over 35 currencies, including the rapidly expanding Bitcoin and Ethereum, as well as a range of other assets, such as commodities, equities, and indices.

Due to the volatility and sharp price swings in popular cryptocurrencies, this brokerage offers lower payouts compared to others, but still provides exceptional customer support services alongside an intuitive platform. Additionally, they offer a fair-market payout for binary options trading in general.

Features

- RegulatDeposit MISA

- MinimumTradesit: $5

- Minimum Per Trade: $1

- Demo Account: Available

- Mobile Trading: Supported

- Instruments: Stocks, Crypto and Binary Options

(Risk Warning: Your capital can be at risk.)

IQ Option

IQ Option is a legal trading platform in Mexico. A brokerage that provides its services to many countries, including South Africa, Singapore, Brazil, Argentina, Mexico, Thailand, Peru, the United Arab Emirates, Switzerland and Taiwan. They have won multiple awards and are recognised by industry experts, allowing traders to customise the platform to better fit their needs. IQ Option offers more than 300 + assets, including those for forex, cryptocurrencies, and commodities.

With an intuitive interface and a team of professionals offering 24/7 support, IQ Option is a favourite for beginners and experienced traders. It also provides various payment systems, allowing convenient withdrawals (1-3 days).

Features

- Instruments: CFDS, Forex, IndDepositetals

- MiniTradeeposit: $10

- Minimum Trade: $1

- Payout: Up to 100%

- Expiry Times: 30 seconds to 1 month

- Mobile Apps: Supported (ios and Android)

(Risk Warning: Your capital can be at risk.)

2. Sign up for a trading account

Regardless of the company or type of account you select, you’ll need to have a few things ready before starting the account opening process. To register your account, you will need to provide your basic personal information. This information includes your date of birth, social security number, and nature of employment.

You’ll be asked about your attitude toward accepting financial risks and how long you expect to hold the investments.

You don’t need to worry about whether your answers are precise to the per cent or penny. This information is not required for verification and is used by the broker to create a more accurate risk profile to help you reach your goals. If circumstances change and you wish to access riskier asset classes, you can always return to the site’s profile section and adjust your answers.

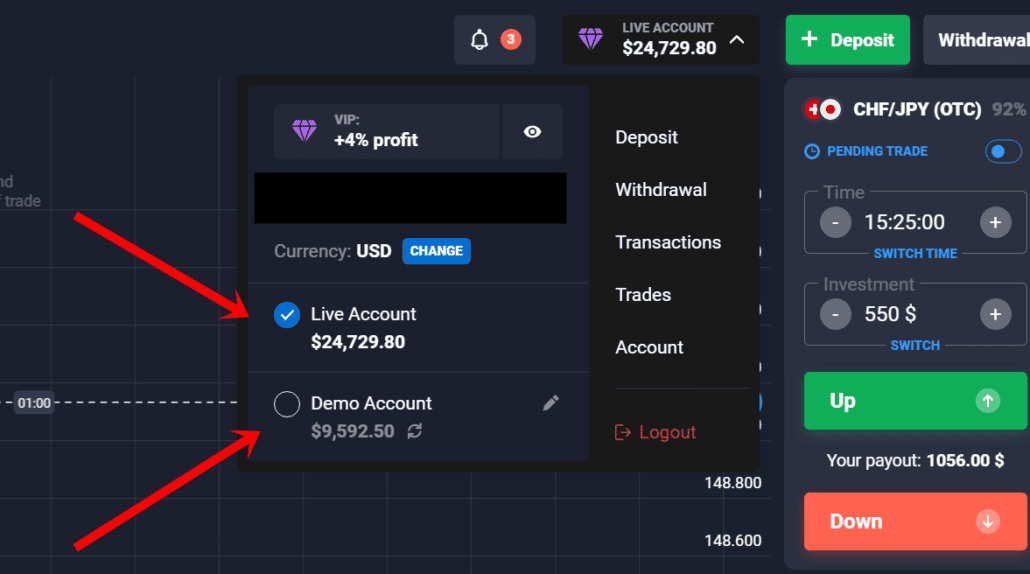

3. Use a demo or live account

A demo account for binary trading isn’t just for newbies. Even seasoned traders often do demo tests. Your strategies may not always work as expected due to mistakes, market shifts, psychological factors, and other causes.

A binary demo account lets you learn the ropes and get a feel for the current market conditions without incurring any losses. For more seasoned traders, it allows them to refine and tweak their strategies without risking their capital.

If you’re new to binary options trading, start with a demo account to understand how it works. If you’re a seasoned trader and are already familiar with binary options trading, feel free to jump into your live account.

4. Pick an asset to trade

New traders and beginners should select a small number of assets to practice with and become familiar with a demo account before trading on a live account. However, most traders focus on a single asset class, industry, or market. If you’re new to binary options trading, start with just one asset to familiarise yourself with specific market behaviours, price patterns, and strategies without the distraction of constantly shifting between different markets.

For seasoned traders, you can familiarise yourself with the platform before jumping into trade with your usual choice of assets.

5. Make an analysis

In binary options trading, charts use indicators to evaluate market behaviour. Traders use these indicators to detect patterns and trends in the underlying markets, which inform their trading decisions. Indicators are a common component of many traders’ strategies, helping to analyse market dynamics.

Some Technical Indicators:

- Moving Averages: Track price trends by averaging past prices. Rising or falling averages indicate uptrends or downtrends.

- RSI (Relative Strength Index): Use this momentum indicator to identify overbought (>70) or oversold (<30) conditions, hinting at potential reversals.

- Bollinger Bands: Assess market volatility as these bands widen (indicating high volatility) or narrow (indicating low volatility) around a moving average.

- Stochastic Oscillator: Gauge momentum by comparing current prices to their range over a specific period, with values above 80 (overbought) or below 20 (oversold) signalling possible changes.

For beginners new to binary options trading, look up a simple strategy you understand and would like to apply to your chosen asset. Feel free to refine these strategies as long as they work for you. After all, every trader has a different style.

For seasoned traders, once you’ve become accustomed to the trading platform, you can check out our list of updated strategies.

6. Place the trade

Binary options are one of the most straightforward options contracts to trade since traders make decisions based on whether they think the value of an asset will go up or down. With just two options, binary options appeal to beginner traders new to the financial markets. Traders must decide which option to stake and place a binary options trade.

For beginners, placing a binary option is a good way to understand how the option’s price fluctuates as the asset’s price moves. As you gain experience, you may increase the trade investment amount per trade to reap more profits.

For seasoned traders, once you’ve gotten used to the platform, you can place trades according to your analysis.

(Risk Warning: Your capital can be at risk.)

7. Wait for the result

Binary options trading concludes with either a fixed payout or no payout, based on the contract’s terms at expiration. Once a trade ends, the outcome reveals if the asset’s value increased or decreased, aligning with the binary nature of the options.

Success in a binary options trade means that the trader’s prediction was accurate, resulting in a payout. Conversely, a mismatch between the trade outcome and the trader’s forecast results in no payout.

Traders can use the outcome of their previous trades to refine their strategies for improved accuracy in future trades or to maintain their current trading approach.

Payment Methods for Traders in Mexico

Here are some of the most typical deposit and withdrawal methods for trading binary options in Mexico:

- Electronic fund transfers—The SPEI and CCEN handle interbank and intrabank financial transactions in Mexico. The SPEI is owned and controlled by the nation’s central bank, while a private owner, CECOBA, runs the CCEN.

- Digital Wallets – In Mexico, payment processors like PayPal are also accepted. This is often a secure approach since such accounts are linked to bank accounts, which makes it easier to verify the trader and the broker. To improve the system’s efficiency and transparency, the Mexican government is promoting the use of electronic payment methods over cash or checks.

- Online banking – Without relying on payment gateways or physical cash, internet banking has become a practical transaction method. Accounts can be funded directly through online transfers and deposits.

- Credit and debit cards—Mexican banks like BanCoppel and Banco Azteca offer international credit cards, such as Visa, MasterCard, and American Express, which are also popular there.

How Do You Make Deposits and Withdrawals in Mexico?

How do I deposit?

As covered above, you may fund your account in several ways. Various deposit options are available depending on the broker. After logging into your account, select the deposit page. You may pick the most convenient way to add money to your account here.

To deposit funds, traders can follow these steps:

- To deposit, visit the broker’s website or open the application.

- Log in to your trading account.

- Click on the ” deposit funds” or ” add funds” option that the broker offers.

- Enter the deposit amount.

- Choose a payment method.

- Authenticate the payment

After traders validate their payment, the broker verifies it and deposits the entered amount into your trading account. YoTrade uses this amount to trade binary options and earn profits.

How do I withdraw?

Most platforms dictate how you withdraw based on the deposit you made. If your account was funded with an e-wallet, you may only be allowed to withdraw money back into the same e-wallet. On the withdrawal page, you may make a withdrawal application. Depending on the broker, the withdrawal process can range from a few hours to a few weeks. Additionally, depending on your location, conditions may change.

To withdraw funds, traders can follow these steps:

- Select the ‘Withdraw Funds’ or ‘Withdraw My Funds’ option on the dashboard.

- Enter the amount you want to withdraw.

- Choose a withdrawal method.

- Submit the request

After traders validate their payment, the broker verifies it and deposits the entered amount into your trading account. YoTrade uses this amount to trade binary options and earn profits.

Pros and Cons

The most significant benefits of investing in Mexican binary options are the opportunities for quicker growth than you can find with U.S.-based firms and the chance to diversify outside of U.S. corporations. Investing in Mexican equities has its advantages and disadvantages.

Pros

Potential for rapid expansion

Mexican businesses offer traders a chance for high gains because they are part of a rising market driven by cheaper labour and energy costs.

Diversification

There are risks involved when investing in just a single industry, and risks also exist when traders invest in a single nation on a larger scale. Mexican stocks offer a distinctive type of diversification that is not possible with U.S.-based investments.

United States-Mexico-Canada Agreement (USMCA)

The NAFTA successor puts Mexico on equal footing with more developed countries and is expected to benefit Mexican businesses and employees, potentially boosting the country’s overall economy.

Cons

Financial risk

Mexico’s GDP has been broadly consistent, indicating steady growth, which suggests that Mexico’s economy is healthy. However, like any country’s economy, its growth may decrease unexpectedly due to changing market conditions.

Political hazard

Risk resulting from political variables can take many different shapes. Markets may be affected by uncertainty and government activities, which, in the case of Mexico, can be either measures taken by the Mexican government or those taken by the United States government.

Conclusion: Binary options trading is Available in Mexico

Binary options trading is fully available in Mexico, allowing traders to access various financial instruments with potentially profitable outcomes.

Many brokers in Mexico offer easy-to-use platforms, making it simple for beginners to get started. The open trading market offers different trading opportunities on stocks, currencies, and other financial instruments. With careful research and the right approach, trading binary options in Mexico can be rewarding for both new and experienced traders.

Frequently Asked Questions (FAQ):

Are binary options legal in Mexico?

Yes, they are legal. Regulations in Mexico are becoming tighter, enhancing transaction transparency. But the market is not yet structured.

Is trading binary options secure in Mexico?

Although trading binary options in Mexico can be secure, given that the market is still relatively new and unregulated, there may still be risks. Traders should conduct sufficient research on the broker they want to choose.

In Mexico, is it possible to profit from binary options?

The Mexican Peso is highly volatile, providing traders with more opportunities for financial gain. However, one must be aware of the dangers involved and make well-informed selections. Of course, brokers often offer other instruments besides the peso.