Yes, binary options trading is legal in Comoros.

The Comoros’s financial markets are regulated by the Central Bank of Comoros (Banque Centrale des Comores). The Central Bank oversees the country’s economic system, including banking regulations and monetary policy, to ensure stability and integrity within the financial sector.

The financial market in Comoros is relatively small and less developed compared to larger economies, and the regulatory framework might not specifically address or explicitly regulate binary options trading.

Let’s find out more about binary options trading in Comoros.

A Step-by-Step Guide to Trading Binary Options in Comoros

Our detailed guide below is tailored for those interested in binary options trading in Comoros. It is crafted to assist newcomers and those returning to the trading scene after a hiatus, offering essential insights and strategies to navigate the Comorian market effectively.

Whether starting from scratch or looking for a comprehensive review to reignite your trading endeavours, our guide provides the foundational knowledge and tips needed to embark on your trading journey in Comoros.

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

from $ 5

(Risk warning: Trading is risky)

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

from $10

(Risk warning: Trading is risky)

1. Pick an available binary options broker in Sri Lanka

Quotex

Quotex is a legal digital options trading platform that has existed for a while. Maxbit LLC was established in early 2022, and its headquarters are in Seychelles.

Its proprietary trading platform offers a breath of fresh air to binary options traders. Traders can access the platform on their smartphones, tablets, or desktop computers via the browser of their choice. However, if you prefer working on your tablet or phone, you should download the Quotex app instead for seamless trading.

Anyone interested in testing the broker’s platform may use a Quotex demo account. It is entirely free and even provides virtual dollars that you can use to trade any of the online assets now accessible to you.

Quotex clients have access to over 100 forex pairs, commodities, crypto, indices, and stocks, all of which can be traded on the firm’s platform. The firm also features an around-the-clock customer support centre to help its customers in over 20 languages.

Quotex at a glance:

- The broker requires a minimum deposit of $10

- Its leverage is 1:1.

- You can choose between the 12 account currencies available: UAH, VND, THB, KZT, RUB, MYR, INR, BRL, IDR, EUR, GBP, and USD.

- The broker doesn’t charge other fees.

- The firm offers deposit bonuses and various promo codes.

- The firm accepts FK Wallet, Bitcoin Cash, Piastrix, Binance Coin, Mastercard, Perfect Money, and Visa for deposits and withdrawals.

(Risk warning: You capital can be at risk)

IQ Option

With over nine years of experience in binary options trading, IQ Option is one of the oldest and most trusted brokers on our list. Its headquarters are in Cyprus, St. Vincent, and the Grenadines.

A legal trading platform operating in Comoros, the firm’s trading platform is customizable and can cater to professional and newbie traders. It is compatible with any desktop, browser, tablet, and smartphone. Additionally, the platform can be downloaded as an IQ Option app for mobile and desktop devices.

This broker offers a lot of online assets. This includes forex pairs, indices, ETFs, CFDs, crypto, and options. These assets can also be traded using the broker’s free IQ Option demo account.

IQ Option boasts a very responsive customer support service that is available 24/7. Representatives can assist you in over 20 languages via email, live chat, or phone.

IQ Option at a glance:

- The broker requires a minimum deposit of $10

- Its leverage is 1:500.

- You can choose between the three account currencies available: USD, GBP, and EUR.

- The broker doesn’t charge other fees.

- The firm offers bonuses.

- The firm accepts Visa, Skrill, Neteller, WebMoney, Mastercard, Perfect Money, and Advcash for deposits and withdrawals.

Pocket Option

Pocket Option is a legal and popular international broker offering clients binary options trading. Founded in 2017 in the Marshall Islands, this firm aims to provide professional binary options trading services to anyone worldwide.

Clients can take advantage of its proprietary platform’s social trading feature. The platform is also straightforward to understand and use, making it ideal for those who have just started trading. The broker even offers a free Pocket Option demo account to anyone wishing to practice or test the software. The available assets on this broker’s platform are stocks, crypto, forex, and commodities.

Assistance is also available around the clock via chat, phone, or email. The representatives support over five languages.

Pocket Option at a glance:

- The broker requires a minimum deposit of $5

- Its leverage is 1:100.

- USD is the default account currency.

- The broker doesn’t charge other fees.

- The firm offers bonuses.

- The firm accepts Payeer, Advcash, Perfect Money, Jeton, Mastercard, WebMoney, and Visa for deposits and withdrawals.

- The broker is regulated by MIWA

(Risk warning: You capital can be at risk)

2. Sign up for a trading account

Before setting up an account, brokers typically ask for personal information from traders, including proof of address, ID card number, and tax details, especially in Colombia. While it may seem overwhelming to first-time traders, this verification step is standard. It ensures compliance with stringent regulations aimed at preventing money laundering and fraud.

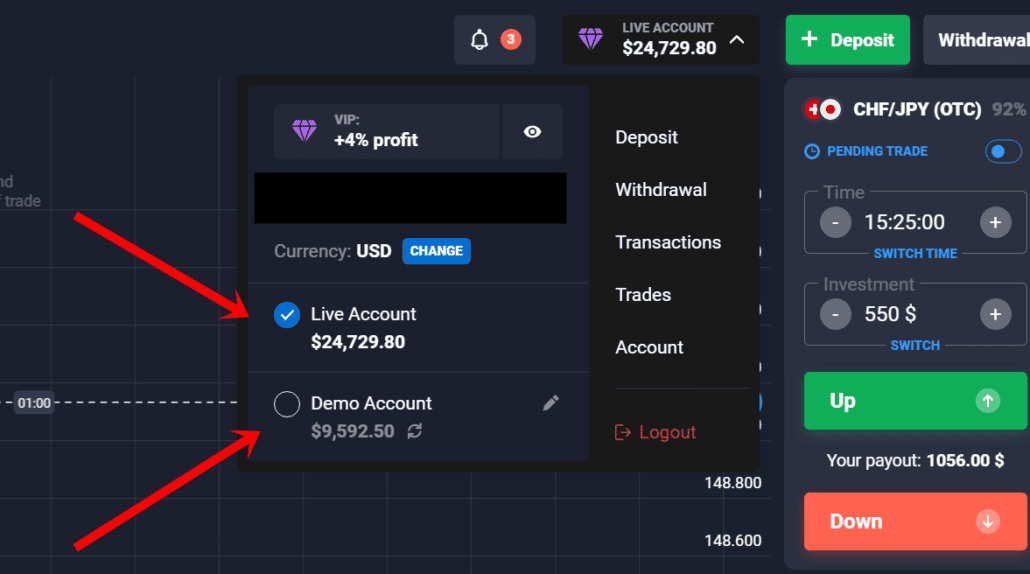

3. Use a demo or live account

Most brokers provide demo accounts, enabling traders, particularly in Colombia, to familiarize themselves with the platform and practice trading without risking actual funds. These accounts offer a safe environment to experiment with different trading strategies, features, and tools, adding valuable experience before transitioning to live trading.

4. Pick an asset to trade

New traders, especially those in Colombia, are advised to start with a limited selection of assets on a demo account before diving into live trading. Focusing on a single asset can help you understand specific market dynamics, price movements, and strategies without the confusion of juggling multiple markets. This focused approach is beneficial for grasping the nuances of binary options trading.

Even seasoned traders should familiarize themselves with the platform using their preferred assets before engaging in regular trading activities. This preparatory step ensures a smooth transition to the new trading environment and a better understanding of the available tools and features.

5. Make an analysis

Broker platforms offer technical indicators to assist traders in their analysis. These indicators act as pivotal signals within trading strategies for optimal entry and exit points.

These technical indicators fall into three main categories:

- Rend Indicators: These highlight the direction of price movements and can occasionally be called oscillators due to their fluctuating nature.

- Momentum Indicators assess the strength of a market trend and can also help pinpoint potential reversal points in trading patterns.

- Volatility Indicators: These gauge the intensity of price fluctuations caused by market changes, providing insight into market instability levels.

6. Place the trade

After analyzing the asset and choosing an expiry time, Colombian traders are ready to execute a binary options trade, where they’ll decide on their market forecast and potential earnings. The standard choices are “Up” and “Down” or “Higher” and “Lower,” which predict whether the asset’s price will rise or fall below a specified level at expiration.

New traders are advised to start with small investments to familiarize themselves with how the option’s value changes with market dynamics. As confidence and understanding grow, the investment size can be gradually increased.

Experienced traders can proceed with trades based on their analyses once they are comfortable with the platform’s features and functionality.

(Risk Warning: Your capital can be at risk.)

7. Wait for the result

Once the trade is in motion, traders must patiently await the result, which can be an anxious period as it confirms the accuracy of their forecast. It’s essential to resist the urge to exit the trade early unless early closure aligns with your predefined trading approach. Upon receiving the trade outcome, documenting each transaction is crucial for monitoring progress and refining strategies. Regularly reviewing these records can guide whether to adjust tactics or persist with the current plan.

(Risk Warning: Your capital can be at risk.)

How Do I Deposit Funds into My Trading Account?

To successfully fund your account, you must choose the payment option that will provide you with the most flexibility. A wire transfer is a payment technique that lets investors deposit money into their trading accounts via their financial institutions.

Your financial institution will provide you with a token pin that must be entered into the broker’s system. After confirming the token, the funds should automatically appear in your broker’s account.

In addition, you may fund your account with your credit card or an electronic wallet. A credit or debit card requires you to use either a credit or debit card. Putting money into your Binary Options live trading account may sometimes be done using gift cards, which certain brokers accept.

Before you may trade on the brokerage platform you are using, you must make an initial payment. You will not be tolerated if you attempt to make deposits less than the starting amount. You can only make deposits equal to or greater than the original amount.

How Do I Withdraw Funds from My Trading Account?

It is relatively easy to withdraw your trade profits. The word “withdrawal” is often shown in clear text on your phone or desktop’s user interface. When you tap on it, you can choose where you want the money to go as soon as it’s activated.

You can pick the payment that will be made into your bank account. This indicates that the money you deposited with the brokerage will be removed from their account and transferred directly into the account you provided them with. Processing time is often required for this procedure. When the money is sent to your account, you will be notified through the notification system.

If you don’t want to deposit the money back into your bank account, you may deposit it into an electronic wallet if you have one. Remember that there may be a fee for withdrawing money from your bank account or e-wallet. Depending on your trading broker, you may or may not have to pay a withdrawal charge.

Conclusion: Binary Options trading is available in Comoros

In wrapping up this step-by-step trading guide, it’s crucial to emphasize the importance of dedicating time to thoroughly understand the asset you’re trading and the intricacies of how trading operates. Mastery of these elements forms the backbone of successful trading strategies. Equally important is maintaining a level head; allowing emotions to steer your trading decisions can lead to undue risk and potentially detrimental outcomes.

Combining a solid grasp of trading fundamentals with emotional discipline sets a strong foundation for making informed decisions and navigating the markets more effectively. Remember, the path to trading proficiency is a journey, not a sprint, marked by continuous learning and measured thoughtful actions.

Frequently Asked Questions:

Can I trade binary options with offshore brokers from Comoros?

Yes, traders in Comoros can choose to trade with offshore brokers since there are no restrictions on doing so. However, it’s essential to select reputable brokers with a track record of reliability.

What assets can I trade with binary options in Comoros?

Binary options traders in Comoros can access various assets, including currencies, stocks, commodities, and indices. This diversity allows traders to explore different markets and diversify their portfolios.

How can I deposit funds for binary options trading in Comoros?

Traders in Comoros have various deposit options, including bank cards (Visa and MasterCard) and bank wire transfers. It’s crucial to choose a secure and convenient payment method offered by your chosen broker.

What strategies should I use for binary options trading in Comoros?

Successful binary options trading in Comoros relies on sound strategies and market analysis. Traders can employ various techniques to make informed trading decisions, including technical analysis, fundamental analysis, and risk management strategies.