Yes, binary options trading is legal in Djibouti.

Binary options trading is legal in Djibouti as the Central Bank of Djibouti (Banque Centrale de Djibouti, BCD) does not regulate it. Djibouti does not have a specific regulatory framework for binary options and the lack of local restrictions allows traders to engage with reputable offshore brokers that operate under well-established global regulatory bodies.

However, due to the absence of local oversight, it is essential to choose a reliable and regulated broker to ensure a secure trading experience. This guide will walk you through the top brokers available, essential trading tutorials, and key considerations to help you trade responsibly and effectively.

Key facts on binary options trading in Djibouti

- Traders from Djibouti can begin trading binary options within a day by signing up with one of the brokers recommended in this article. However, some brokers may take up to a week to approve and register their trading accounts.

- Traders should carefully choose brokers that are reputable and, ideally, regulated by well-known international authorities like the CySEC (Cyprus Securities and Exchange Commission) or FCA (Financial Conduct Authority in the UK). The broker should offer services in Djibouti and provide adequate customer support.

- Stay informed about Djibouti’s economic indicators and political news, as these can substantially affect market conditions and trading opportunities.

A Step-by-Step Guide to Trading Binary Options in Djibouti

Dive into binary options trading in Djibouti with this straightforward guide. Perfect for beginners and seasoned traders, we’ll walk you through the basics, from navigating Djibouti’s trading regulations to choosing the right platform and mastering risk management. Start your binary trading journey in Djibouti today and unlock new trading opportunities.

1. Pick an available binary options broker in Djibouti

Choosing a binary options broker without careful evaluation and due diligence can be a gamble. Traders must make informed decisions based on key criteria such as the broker’s adherence to regulatory standards, their standing in the market, and the diversity of assets available for trading.

Choosing the right broker is crucial for successful binary options trading. It’s best to go with a broker that’s widely used and comes highly recommended, as shown by its positive reviews. We’ve carefully reviewed brokers worldwide to bring you a shortlist that works well for beginners and seasoned traders. This list includes the top picks that promise a reliable and smooth trading journey.

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

100+ Markets

- Min. deposit $10

- $10,000 Demo

- Fast Execution

- High Profit up to 95%

- Fast Withdrawals

- Free Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Welcomes International Clients

- Offers High Payouts: 90% – 97%+

- Professional-grade Platform

- Swift Deposit Process

- Enables Social Trading

- Provides Free Bonus Incentives

from $ 5

(Risk warning: Trading is risky)

300+ Markets

- $10 Minimum Deposit

- Free Demo Account

- High Return Up To 100% (in case of a correct prediction)

- The Platform Is Easy To Use

- 24/7 Support

from $10

(Risk warning: Trading is risky)

Quotex

Quotex, established by Maxbit LLC in 2020 and based in the Republic of Seychelles, is a legal digital binary options broker. Its user-friendly platform is accessible from any device with internet access, making it ideal for beginners in Djibouti. Quotex offers a demo account with virtual funds for those new to trading, allowing for risk-free practice.

The platform supports trading in various assets, including stocks, indices, commodities, cryptocurrencies, and over a hundred currency pairs. Quotex also provides 24/7 customer support in more than twenty languages, ensuring traders have the assistance they need anytime.

Quotex at a glance:

- An initial deposit of $10 is required from the trader.

- Its leverage ratio is 1:1.

- Account currencies are USD, IDR, GBP, EUR, INR, BRL, RUB, MYR, THB, UAH, VND, and THB.

- The broker imposes no extra fees.

- There are several deposit bonuses and promo codes available.

- The firm accepts withdrawals and deposits from FK Wallet, Bitcoin Cash, Piastrix, Binance Coin, Mastercard, Perfect Money, and Visa.

(Risk warning: You capital can be at risk)

IQ Option

IQ Option stands out as one of the industry’s most seasoned brokers, with a nine-year legacy that underscores its extensive experience. With operational bases in Saint Vincent & the Grenadines, IQ Option caters to a broad spectrum of traders, from novices to seasoned professionals. The platform is highly accessible and compatible with various devices, including tablets, laptops, and smartphones. It also offers a free app for both desktop and mobile use.

Djibouti traders using IQ Option have access to a diverse range of digital assets, encompassing FX pairs, indices, CFDs, ETFs, cryptocurrencies, and options. Through a demo account, users can engage in risk-free trading to sharpen their skills in a simulated market environment.

Priding itself on exceptional customer support, IQ Option ensures assistance is readily available 24/7. The support team, proficient in over 15 languages, can be contacted via phone, online chat, or email and is ready to aid traders with any inquiries.

IQ Option at a glance:

- An IQ Option initial deposit of $10 is required from the trader.

- Its leverage ratio is 1:500.

- Account currencies available are GBP, USD, and EUR.

- IQ Option imposes no extra fees.

- There are several deposit bonuses and promo codes available.

- The firm accepts Perfect Money, Skrill, WebMoney, Mastercard, Neteller, Visa, and Advcash for withdrawals and deposits.

(Risk warning: You capital can be at risk)

Pocket Option

Pocket Option is a well-known worldwide broker that provides customers access to the binary options trading market. Traders using Pocket Option in Djibouti can participate in social trading on the firm’s proprietary trading platform, which is made available to them by the company. The technique is ideal for new traders since it is simple.

Customers may also try out the software with a free Pocket Option demo account provided by the broker. Shares, cryptocurrencies, fiat currency, and commodities contracts may be traded on this firm’s platform. Additionally, assistance is available over chat, phone, and email twenty-four hours a day, seven days a week. The personnel speak more than five languages fluently.

Pocket Option at a glance:

- An initial deposit at Pocket Option of $5 is required from the trader.

- Its leverage ratio is 1:100.

- USD is the available account currency.

- The broker imposes no extra fees.

- There are several deposit bonuses available.

- The firm accepts Payeer, Advcash, Perfect Money, Jeton, Mastercard, WebMoney, and Visa for withdrawals and deposits.

(Risk warning: You capital can be at risk)

2. Sign up for a trading account

Engaging in binary options trading in Djibouti requires using a legally recognised broker. The initial task is to scout for a broker with regulatory approvals that align with your trading goals. Upon selecting a suitable broker, you’ll need to furnish them with your details by completing their online registration process.

This step is crucial for setting up your trading profile. Following this, you’ll set your trading parameters according to your strategy and risk tolerance. Finally, to activate your trading capabilities, you’ll deposit an initial amount into your account, paving the way for you to dive into the binary options market.

(Risk Warning: Your capital can be at risk.)

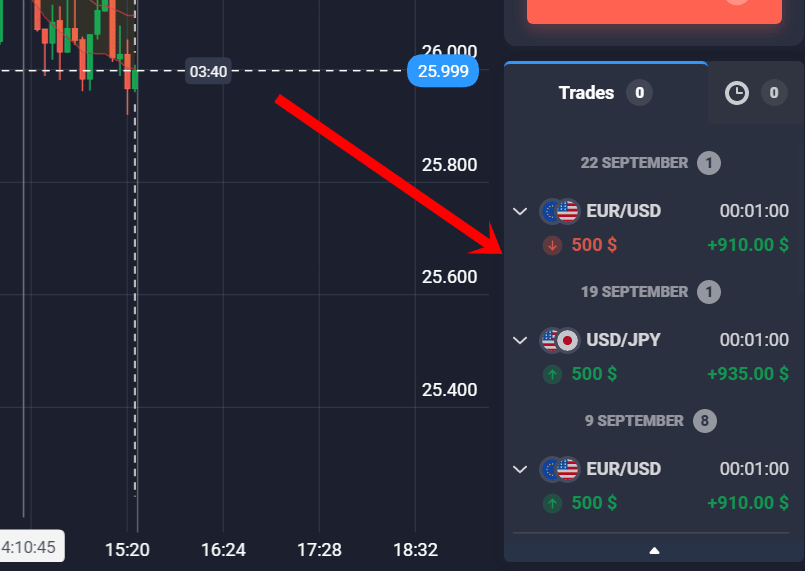

3. Use a demo account

Platforms typically offer demo and live account options when trading binary options. For newcomers or those seeking to refine their trading strategies, it’s advisable to begin with a demo account. This lets you familiarise yourself with the trading process and practice without financial risk.

On the other hand, experienced traders confident in their understanding of binary options and market dynamics may opt for a live account. Regardless of your choice, ensure you grasp the fundamentals of binary options trading and the specific features of your chosen platform before diving into live trades.

4. Pick an asset to trade

Choosing the right asset is a critical step in binary options trading, equally significant as determining the trade direction. Opting for an asset with higher volatility can offer greater returns than one that moves more slowly.

Take the time to research and understand the assets available through your broker, considering factors like market trends, historical performance, and your comfort level with the asset’s volatility. This informed choice can significantly impact the outcome of your trades.

5. Make an analysis

Before placing trades in binary options, thoroughly investigate the asset’s history and current market trends. Use the analytical tools provided on your trading platform to scrutinise past performance and predict future movements.

Consider these insights carefully and let them guide your trading decisions. Remember, a well-informed decision is the cornerstone of successful trading.

(Risk Warning: Your capital can be at risk.)

6. Place the trade

After selecting a reputable broker and setting up your account, you’ll execute trades directly from the trading platform. Keep a close eye on the movement of your chosen asset, understanding that its value will likely experience fluctuations.

To navigate these changes effectively, base your trading decisions on thorough analysis and market trends. Remember, successful trading hinges on informed decision-making and timely responses to market dynamics.

7. Wait for the result

As mentioned, the market might go up and down, and it can be tempting to exit the trade to minimise losses or take profits early. Still, if you are confident in your analysis, waiting is always better. We advise traders to monitor their finished trades and note their success rates.

Recording trades means traders can notice if their success rates are decreasing over time, which means they may have to tweak their trading strategy to remain consistently profitable.

Conclusion: Binary Options trading is available in Djibouti

Binary options trading is available in Djibouti but it is not easy to choose a decent binary options broker. There are several factors to consider, such as the fees when withdrawing your profits and how responsive their support is. We suggest for traders to check out these brokers in detail either on our reviews website or googling to find out more about what services they can provide for traders before settling with one.

Remember to implement risk management rules that you will follow. This will help reduce your chances of losing all your funds.

Frequently Asked Questions (FAQ)

What assets can I trade with binary options in Djibouti?

Binary options trading platforms in Djibouti typically offer a wide range of assets, including currencies (forex), stocks, commodities, and indices. Traders can choose from various options to diversify their portfolios.

How can I deposit funds for binary options trading in Djibouti?

Traders in Djibouti can deposit funds through various methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrency. Choose a method that is convenient and secure for you.

Are there any risks associated with binary options trading in Djibouti?

Like any form of trading, binary options trading carries risks. It’s essential to be aware of potential risks, including market volatility, loss of investment, and the possibility of encountering unregulated brokers. Traders should conduct thorough research and adopt risk management strategies.

How do I choose a reliable binary options broker in Djibouti?

When selecting a broker, consider factors such as regulation, reputation, trading platform features, customer support, and withdrawal policies. Opt for brokers regulated by reputable authorities and with positive reviews from traders.