Traders who are successful can afford to give up their day jobs because of the money they make. Many are afraid to take the essential measures to invest confidently. Few hobbies possess the power to transform lives, like forex and options trading. We’ll give you insights into some methods – such as the best winning Olymp Trade trading strategies.

See the best trading strategies for Olymp Trade here:

- Moving averages (SMA) cross strategy – Easy to understand

- Trade cancellation – To secure your profits

- Fibonacci methods – Best for exact trade signals

- News trading strategy – High winning rate

- Range Trading – Easy to spot

- Price action – Predict the right price direction

(Risk warning: Trading involves risks)

Best 6 trading strategies for Olymp Trade:

There is a variety of different Olymp Trade trading strategies, such as news trading or range trading. Find out which are the most effective ones and how they work. With these strategies, you can predict the future outcome of your trades on Olymp Trade.

1. Moving averages (SMA) cross strategy

Two Exponential Moving Averages are used in this method as indicators on Olymp Trade. One has a period of 8, whereas the other has a period of 20. (EMA 20 and EMA 8.) To make it more successful, you might incorporate a signal confirmation tool like the MACD (Moving Average Convergence Divergence).

Trend following, as well as Exponential Moving Average cross-overs, are used to produce sell and buy signals in the two EMA methods.

In the following fast steps, set up the chart for the 2 EMA part of the 5-minute trading method:

- Decide whether you want a candlestick chart or a bar chart.

- Create a one-minute timer with the candlesticks.

- Change the period of the exchange to 5 minutes.

- On your chart, apply the Exponential Moving Average and set it to 8 periods.

- Draw additional Exponential Moving Average on your chart, this time with a 20-period period.

Tips

- Remember to use various colors for the 2 EMAs to make them easier to distinguish.

- Finally, on your chart, use the MACD (Moving Average Convergence Divergence) indicator.

Your chart is now ready for you to begin trading with this method!

That setup should now generate tradeable signals for you; otherwise, it’s useless. So, how do you use this setup to trade?

If the preceding conditions are satisfied, consider entering a Buy Position:

- The 20-period and 8-period Exponential Moving Averages are both moving up, indicating that the market is in an uptrend.

- Let us say the EMA has a period of 8 crosses over the EMA having a period of 20.

- The MACD confirms that the trend is up.

If the following criteria are satisfied, consider entering a Sell Position:

- The 20-period and 8-period Exponential Moving Averages are both falling, indicating a downward trend.

- Let us say the EMA has a period of 8 crosses over the EMA having a period of 20.

- The MACD indicates a falling trend.

Have all of the requirements been met? Then, put your order to sell and stand in line for the next five candles to form. You have a good chance of succeeding in such a trade.

Pros:

- Easy to use

- High hit rate

- Multiple signals in a short time period

- Suitable for all markets

Cons

(Risk warning: Trading involves risks)

2. Trade cancellation

Olymp Trade’s trade cancellation option is among the most cutting-edge additions to its trading system. Trade Cancellation is indeed a strategy that allows you to have the ability to cancel bad trades.

For example, this Olymp Trade strategy is used when the transaction seems to be heading in your direction. As a result, if after a while (before the trade expiry date), you see that the transaction is not going in your favor, you may choose to cancel the deal. You’re not going to be losing any money.

Pros:

- Easy to use

- It can save you a lot of money when you trade in the wrong direction

- Best for risk management

Cons:

(Risk warning: Trading involves risks)

3. Fibonacci methods

The Fibonacci method may be new to you. Leonardo Pisano, a mathematician, developed the Fibonacci Retracements, which is a collection of price research tools founded in his scholarly studies.

Using Fibonacci levels may help you predict asset price reversals before they happen. Keep in mind that the visual high and low have been used to establish the grid. The remainder of the levels just materialized of their own after that. Additionally, a trader might profit by selling low and buying high at the same time.

How to use it:

First, you have to spot a high and a low. We recommend you to use big price movements and the Fibonacci retracement will be more efficient. Then, you draw the retracement in your charts. The displayed lines can be used as support and resistance areas where you can place your trades with or against the trend.

Pros:

- High hit rate

- The best for trading pullbacks in the trend

- Exact entry points

Cons:

- You will need some basic understanding of analysing charts

(Risk warning: Trading involves risks)

4. News trading strategy

Trading on the basis of market expectations and news occurs both before and after a news release, which is what we mean by a news trading strategy. It might be difficult to trade on the news because of how rapidly it spreads via digital media. You will have to evaluate the news as soon as it is revealed and reach an instant decision on ways to trade it. A few important things to remember are:

- Is an instrument’s price already completely or partly reflecting the news?

- Are there any discrepancies between this news and what investors were expecting?

Economic news may be the most significant factor in the market’s movement. News about the economy includes speeches, events, reports, and data that might aid in forecasting future economic trends.

Large price changes are caused by economic news that has a substantial impact on prospective economic direction. After the Federal Open Market Committee of the US Federal Reserve Bank, big candle moves in assets like currencies, gold, and even stock indexes are not unusual.

Pros:

- High-risk profit rewards

- News are easy to spot

- Fixed timeframes when the news are appearing

Cons:

- Limited news events

- High volatility can be a disadvantage

(Risk warning: Trading involves risks)

5. Range trading

A price range is an area of the market where the value fluctuates between a high and a low.

In order for these levels to be considered a channel, they may be resistance levels and horizontal levels or any other. Is there a way to trade pricing ranges, then?

You purchase at the lower end and resell at the higher end of a range, like resistance and support levels. As a result, the price is likely to revert when it reaches one of these two points.

It becomes more complicated. Don’t get into the market right away. Wait for the top or lower level to be successfully retested. You may trade after that.

Pros:

- High it rate

- Easy to trade

- You can add price action signals to it

- Perfect for candlestick trading

- Available for any market

Cons:

- Not available in trend markets

(Risk warning: Trading involves risks)

6. Price action

It’s widely believed that it is the best Olymp Trade strategy for intraday trading. To be sure, price action is not just useful for learning how to discover good entry opportunities in the market or trading mode. Additionally, it provides you with knowledge about the industry.

In order to begin price action trading at Olymp Trade, what are the prerequisites? To begin, you must acquire a firm grasp of the concepts of support and resistance. It’s like setting a ceiling on the value of an asset. Forewarned is forearmed.

The second is a bar chart or Japanese candlesticks. For traders, this information on price ups and downs over a certain time period is invaluable.

In the picture above, you see a very strong price action signal. The price goes up and then drops like a rock. The candlestick shows it by a wick. These signals are good to trade when volatility is appearing in the market. You could place 2 short trades here!

Pros:

- Available for any market and timeframe

- High hit rates

- Signals are easy to spot

- A lot of different strategy methods

Cons:

- Needs practice

(Risk warning: Trading involves risks)

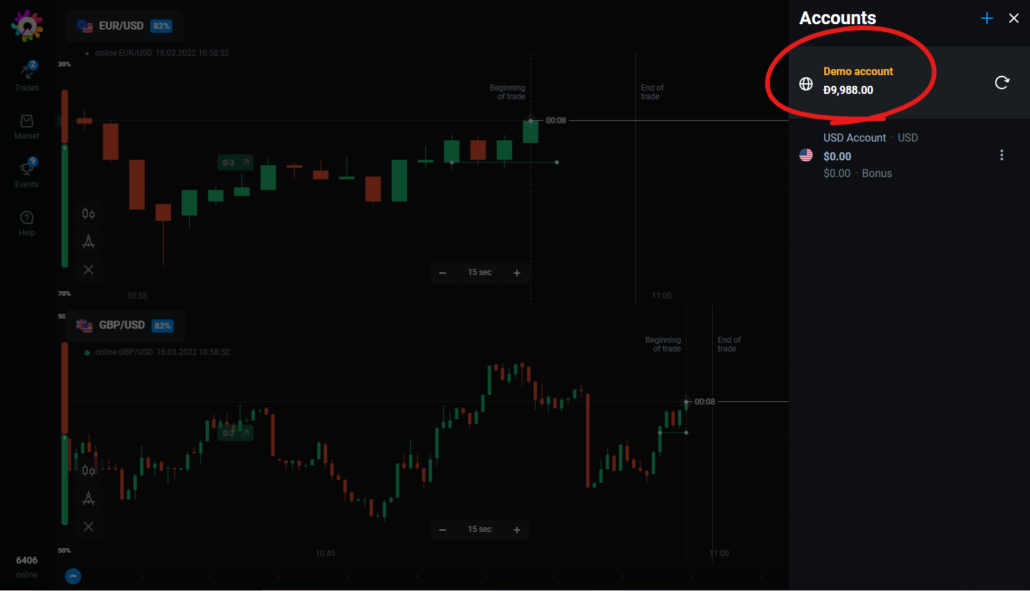

How to start trading on Olymp Trade? – Demo account first

The first step is to sign up for an account on a broker’s website. The most important thing to look for in a broker is reliability. Choose the one you can trust. Olymp Trade has been a Financial Commission member since 2014 and has won several awards.

An account for trading and $10,000 for virtual money is set up instantly when the registration process is completed. In order to trade, you must deposit $10 / €10, and the minimum amount you may trade is $1.

People may invest little and make a lot of money with Olymp Trade. Since its establishment in 2014, the company has served clients and established itself as a dependable resource for anyone looking to engage in online trading. Olymp trade distinguishes itself from other trading assets by offering FX and Fixed Time Traders.

Several secrets to earning profits online may be found on the Olymp Trade. Beginners, on the other hand, feel they have those skills too. It has resulted in a large amount of content on the internet regarding how to profit with Olymp Trade strategies. To learn more about Olymp Trade’s primary methods of making money, keep reading.

(Risk warning: Trading involves risks)

Olymp Trade: How do you earn money with trading strategies?

Step 1: Olymp Trade registration is the first step. Get a $10,000 trial account and a maximum of 50% bonus for newbies when you sign up.

Step 2: If you don’t already have a mobile app installed on your phone, you’ll need to do so.

Step 3: Deposit money into your account.

Step 4: It’s easy and fast to open deals in this step.

Step 5: The last step is to transfer funds to a Visa or MasterCard account.

To begin making money online with Fixed Time Trades (FTT), you must first create a demo account. Beginners may practice Olymp Trade strategies, including exchange-traded and financial assets in actual market circumstances using the demo account’s virtual money, with no danger to their own money.

In order to try and select a method for generating money on the capital markets, you wouldn’t have to deposit any funds into your account.

(Risk warning: Trading involves risks)

How to trade on Olymp Trade:

Options are easier to understand. Select asset, determine the amount to invest, and select a time frame in which your forecast will be proven true.

A skilled trader’s toolbox includes a method for predicting if the value will rise or fall. A trader’s return might be as much as 92 percent if an option is executed correctly. Profit margins are strongly related to market volatility; the more volatile the market, the more profit you make.

Execution times on this platform vary from one minute to three hours. When an individual think that the price of the asset will rise or fall in a given time period, they hit the Up or Down button. The outcome of the forecast will be known at some point in the future. If the investor is accurate, he or she earns an immediate payment.

On Olymp Trade, if you want to earn money, you have to properly estimate if the value of the asset you’re trading will grow or decrease in your trades. This Olymp Trade strategy will help you make predictions in the right direction.

It’s not a good idea to hunt for quick-money tricks or global formulas. Only knowing that each effective trading strategy relies on a precise calculation is all that is needed to succeed. A technique that returns a minimum of 70 percent of its trades is the sole way to make steady and quick money even with a $10 investment.

It’s important to know the fundamentals of stock market trends and who is buying and selling economic assets in order to be successful in this endeavor. When you know who comes out on top in this trade, you’ll be able to hunt for excellent spots in order to create successful deals.

(Risk warning: Trading involves risks)

More about Olymp Trade:

Registering an Olymp Trade profile is the first step to making money from your currency projections. The $10,000 demo money is purely educational and has no financial value. To earn more from accurate forecasts, use a live trading account. One dollar is the bare minimum for any transaction.

Invest some time in learning about the commodities once you’ve set up your accounts. Options are bets on if an asset’s price will increase or decrease over a certain timeframe. Foreign exchange trading is the process of buying and selling currency pairs in order to benefit from market movements.

For novice investors, Olymp Trade offers a comprehensive instructional program to assist them in understanding the strategies, markets, and tools that are necessary to become a professional trader. An awareness of the markets and ways to effectively work within them is critical when dealing with 72 different assets (currency pairings, equities, indexes, commodities, etc.).

Olymp Trade is accessible all over the world. Many countries such as Malaysia, Brazil, Indonesia, India or Nigeria allow legal trading with the platform. Unfortunately, in some countries such as Canada, Japan, the United Kingdom, Australia, Israel, or the United States, it’s not possible to use the platform for trading.

Summary: Win on Olymp Trade with the best trading strategies

Whether you’re looking for a way to tell if the bulls or bears are in power, Price Action or range trading is your best bet.

The strength of bull (buyers) is evident, for example, when the candlestick highs are rising. Finding entry positions near the levels of support and resistance is preferable.

Olymp Trade is a great place to earn money online with multiple deposit and withdrawal options, and maybe our winning Olymp Trade strategies have shed some light on how to do so. Because the financial markets have been operating for a long period of time, all winning trading tactics have been created, tried, and successfully employed by professionals.

(Risk warning: Trading involves risks)

Sam Fernando

says:yeah,

Olymptrade is a easy and reliable platform for forex trading

Thus we use indicators, strategies, and lines like Fibonacci, Parabolic, MACD, SMA, Momentum etc… make our trading easier and risk lesser

thank you for posting